Blog - accounting, controller, Remote Work, technology

Accounting

What G2’s Summer 2022 Report on Close Management Solutions Tells Us About Accounting Technology

Despite the proliferation of technology, the role of financial professionals is more critical than ever.

Whether you’re at a start-up, a scale-up, or a major enterprise, CFOs, controllers, and their teams are taking on a whole new level of decision-making and facing a unique and complex range of challenges.

| THEN | NOW | FUTURE | |

| CFOs | Perceived as high-level “bean counters,” they reported financials, consulted with the senior management, and ran what-if scenarios. | They have earned a seat at the table. Respected for their insights, they advise the CEO and Board and are a crucial part of decision-making. | – CFOs will be evaluated based not only on the quality of their reporting but also on: – Their ability to find automated solutions that improve efficiency and expedite decision-making – Leadership skills, retention rates, and employee satisfaction levels |

| Teams | Tied to their spreadsheets, they worked bleary-eyed into the wee hours at the end of each month. | Remote work and focus on employee wellness have created unique and inclusive teams. They expect, learn, and adopt new technologies to make their jobs and lives easier. | Tech-centric accountants and other financial professionals will use automation to streamline their jobs. Family and vacation time are realities! |

| Culture | Finance and accounting professionals can expect periods of crippling stress. It’s part of the job. | Jobs should be fun (at least sometimes), rewarding, and balanced. People vote with their feet (and scathing online reviews) when dissatisfied. | We won’t even need to discuss it. The companies with the best cultures will simply attract the best talent. And deliver the best results! |

In this blog, we’ll take a look at how accounting teams have evolved over the last few years, what solutions are available to aid them as they scale to meet new demands, and how those resources stack up according to G2 reviews.

Can Software Really Create This Future?

In short: Yes. The right tools can increase individual efficiency, offer clarity as to the progress of the close, and eliminate costly miscommunication.

Imagine what the world would look like if accountants hadn’t traded in ledger sheets for spreadsheets? That seems preposterous!

Accounting teams who are using state-of-the-art software have proven that it:

- Reduces dependence on labor-intensive manual tasks

- Saves on average 3-5 days each month performing those tasks

- Builds employee satisfaction and contributes to retention and better cultures

- Ensures readiness for Board meetings and audits

The right software shortens your close cycle, improves accuracy, reduces stress, and gives you more confidence in financial result reporting.

Okay, great. You now believe that you need a software solution. And lots of companies are knocking on your virtual door, claiming they have the answer. But, before you sign that contract…

Key Considerations — A Buyer’s Guide for Close Management Solutions

The Must-Haves

Selecting automation solutions is always a complex process. There are plenty of options available, but this isn’t a one-size-fits-all situation: The obvious choice might not be the right one for your team. Here’s what you need to look for:

- Seamless Integration with Other Systems. The right software works smoothly with the tools you already use — Excel, ERP, and others.

- Utility for ALL Team Members (not just senior management). Your team will only adopt technology if they genuinely believe it can streamline their work and help them look better to management — whatever level they are!

- Implementation Time. If you’re spending months figuring out how to use new software, you’re not spending time working on and growing your business.

- Training. That’s how #2 and #3 become realities. You want a system that’s easy (and maybe even pleasant) to learn. Make sure the company you’re working with doesn’t just pitch, sell, and walk away.

- Customer Support. See #4. You want to engage a software company that still remembers the human aspects of our industry and treats you like a valued partner.

- An Eye on the Future. The right software provider keeps on top of accounting trends and constantly builds new solutions based on their clients’ needs and wants.

The Questions Buyers Should Be Asking

Software providers will all promise you the world when they’re wooing your company.

They’re eager to take you through a demo, tell you how many hours they can save you, and showcase all the cool bells, whistles, and functionalities their automation tools provide. But be sure to ask them:

- Is anyone on your leadership team an accountant? How do you understand what REALLY goes on at companies throughout the month and during the close?

- Who are some of your clients? What would they say about you (positive and negative)?

- How are new users trained? Who does it?

- How do you ensure data security?

- Do you have live customer service, or is it all online? (No one wants to be sifting through FAQs when they’re up against a deadline)

- What are your plans for product enhancements and integrations?

Why FloQast?

Now that we’ve told you what to look for, here are some of the reasons 1,600 accounting teams (including Twilio, Coinbase, ZOOM, the LA Lakers, and Snowflake) chose us.

- We were built by accountants, for accountants. Our leadership team has been in your shoes.

- FloQast securely links ERP with Excel-based reconciliations.

- FloQast integrates seamlessly with reliable cloud providers (Google Drive, Box, OneDrive, Dropbox, Egnyte, and others).

- Implementation is tailor-made for you and your team.

- Training is simple and available whenever new team members join.

Given the collective accounting experience and knowledge, we’ve developed a number of solutions to address the bevy of responsibilities finance and accounting teams are responsible for on a regular basis.

- FloQast Close: Centralizes all month-end checklist items and supporting documents, so you can assign and track tasks in real-time and collaborate better with review notes

- FloQast Ops: A workflow management solution that addresses upstream financial functions like Accounts Payable, Sales and Use Tax, and Accounts Receivable along with downstream functions like Compliance, Reporting, and FP&A. You get greater control and transparency across accounting operations.

- FloQast ReMind: Like a high-powered personal assistant, it creates simple reminders for expense reimbursements, task confirmations for headcount updates, and more complex information requests like accruals.

- FloQast Reconciliation Management: Consisting of Reconciling Items, AutoRec Matching, and Amortization, FloQast Reconciliation Management is an advanced workflow automation solution that works with FloQast Close to deliver end-to-end account reconciliation management.

- FloQast Flux: FloQast Flux automates the time-consuming process of building a report while giving you the flexibility to meet your unique business needs.

- FloQast Analyze: Build a culture of accountability and remove bottlenecks. You’ll see precisely where opportunities for improvement are and get objective and actionable insights.

- FloQast Connect: Seamless integration with your ERP means your month-end close is more accurate and faster.

The Numbers Don’t Lie

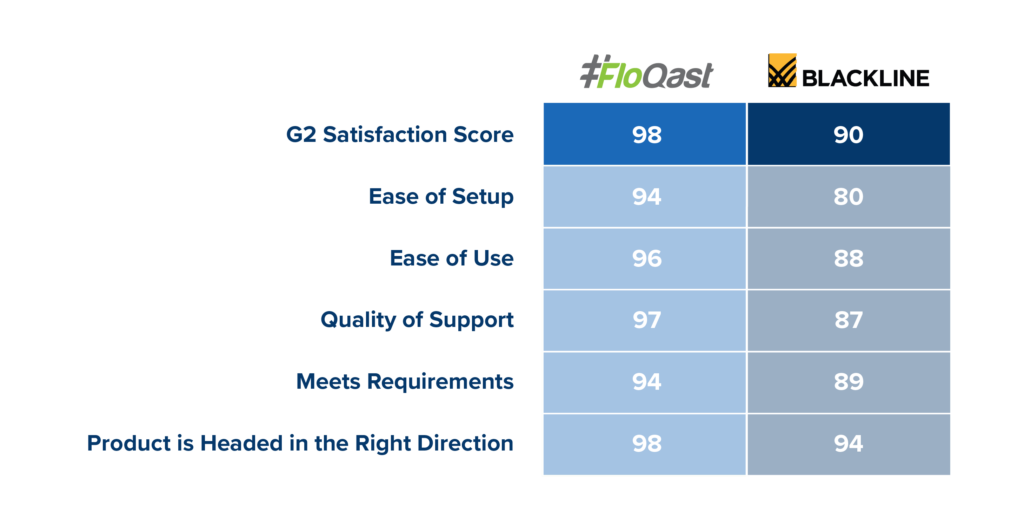

User experience is our priority. Just as you may look at Rotten Tomatoes or Open Table before choosing a film or restaurant, you should also pay attention to what reviewers have to say about software.

Comparing the top two solutions on the market, FloQast’s G2 scores Satisfaction, Ease of Setup, Ease of Use, and Quality of Support outpace the competition by significant margins.

According to G2’s Summer 2022 report on Financial Close Software out, it’s clear that users overwhelmingly prefer FloQast.

- Ranked first in a number of categories for Financial Close software for the sixth consecutive quarter in the G2 Momentum Grid

- The highest Implementation Index score by over 1.49 points at 9.18 (compared to 7.69)

- Financial Close Usability Index score of 9.51 compared to the second-highest score of 8.79

- An industry-leading Relationship Index score of 9.68 out of 10 possible points

It’s not just the users reporting positive things about FloQast. In the last several months, the company has received a number of mentions for its cutting-edge approach to accounting technology.

- Named one of the top 10 Most Innovative Financial Companies by Fast Company in 2022

- Awarded a Bronze Stevie for Customer Service Department of the Year in 2022

- Included in the Technology Fast 500 by Deloitte

- Named Best Place to Work in Los Angeles for four years running

- Heralded in Inc. Magazine’s annual list of best workplaces

Recap: Purchasing vs. Partnering

Only you will know what product and solutions will be right for your team. But given the evolution of the accounting function over the last several years, it’s important to remember that implementing technology isn’t about the boxes it checks now: It’s about bringing in a resource that can scale with the organization as new demands arise.

So, make sure you’re investing in a software that’s:

- Valued by the people who will be using it

- Developed by a company that really “gets” what you need and values your business

- Showcased by the industry for the quality of both its product but also its service, and vision

Buying software isn’t a spur-of-the-moment decision. In the end, it’s about establishing a trusting partnership, not simply signing a contract.