FloQast Reconciliation Management

FloQast Reconciliation Management allows accounting teams to manage and automate the end-to-end reconciliation process with a centralized solution trusted by accountants and auditors worldwide.

Optimize the Reconciliation Strategy and Process

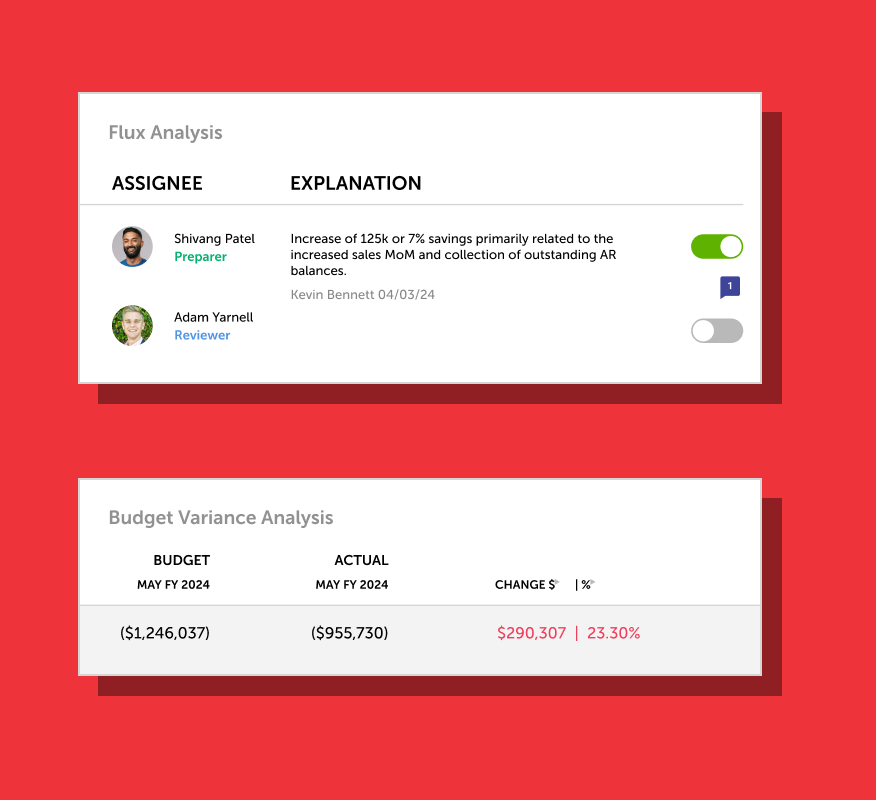

Select an approach that will best address the risks unique to each balance sheet account and best practices to ensure consistency and continuity as your organization scales.

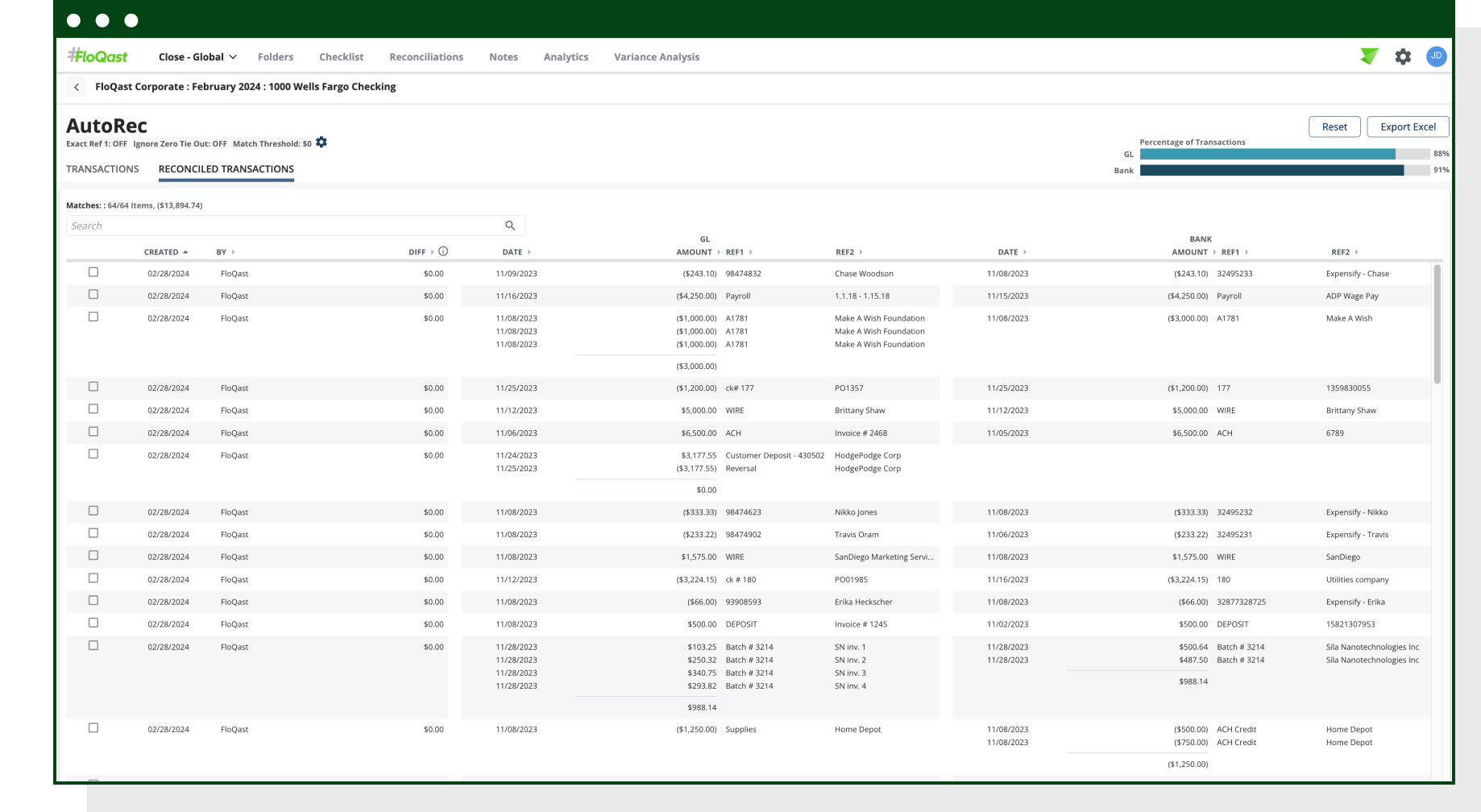

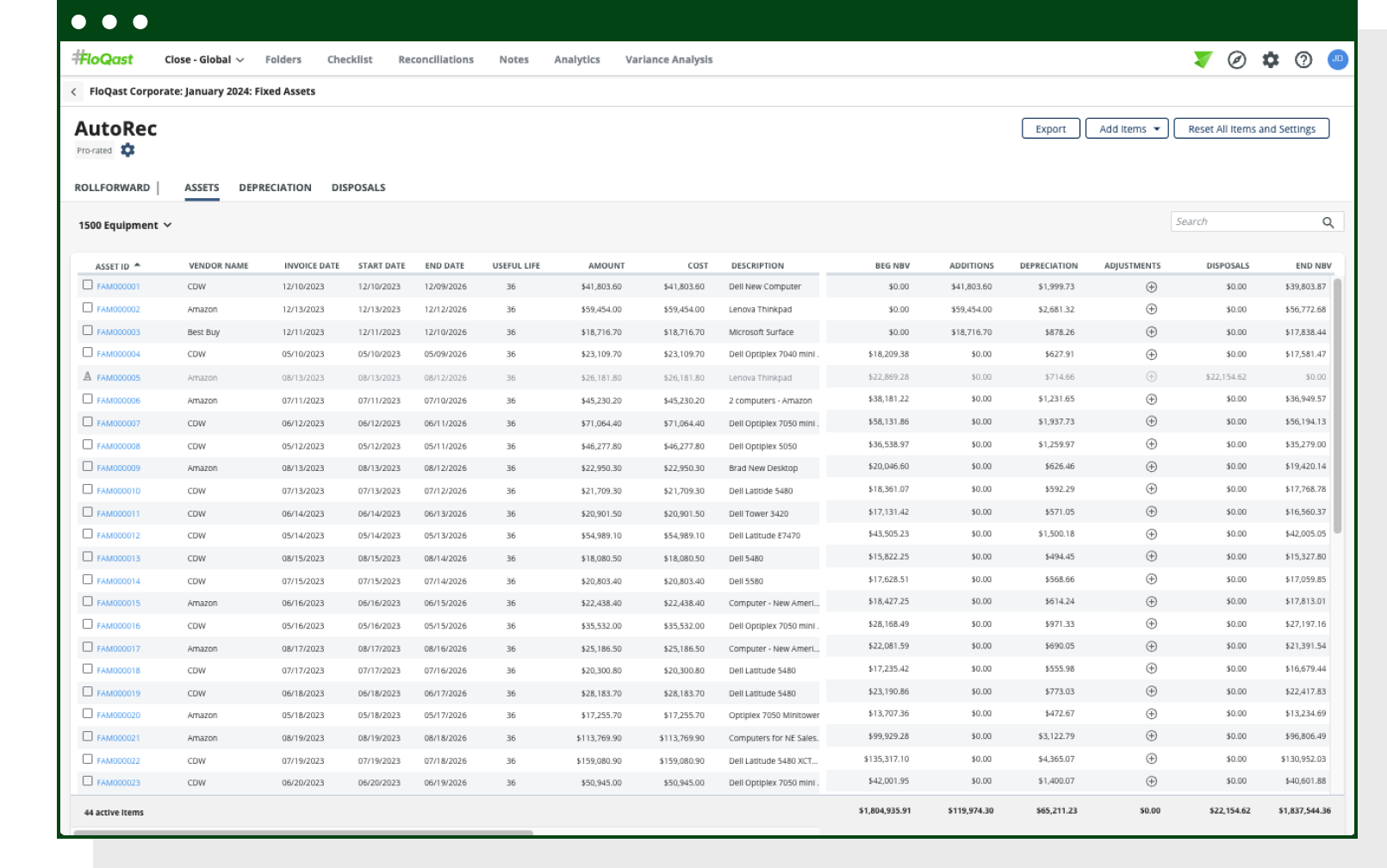

AI-Assisted Automation

Some processes make sense to automate with AI-enhanced machine learning models to minimize human error, while others require manual – but efficient – management. FloQast Reconciliation Management lets you choose the best method for your organization.

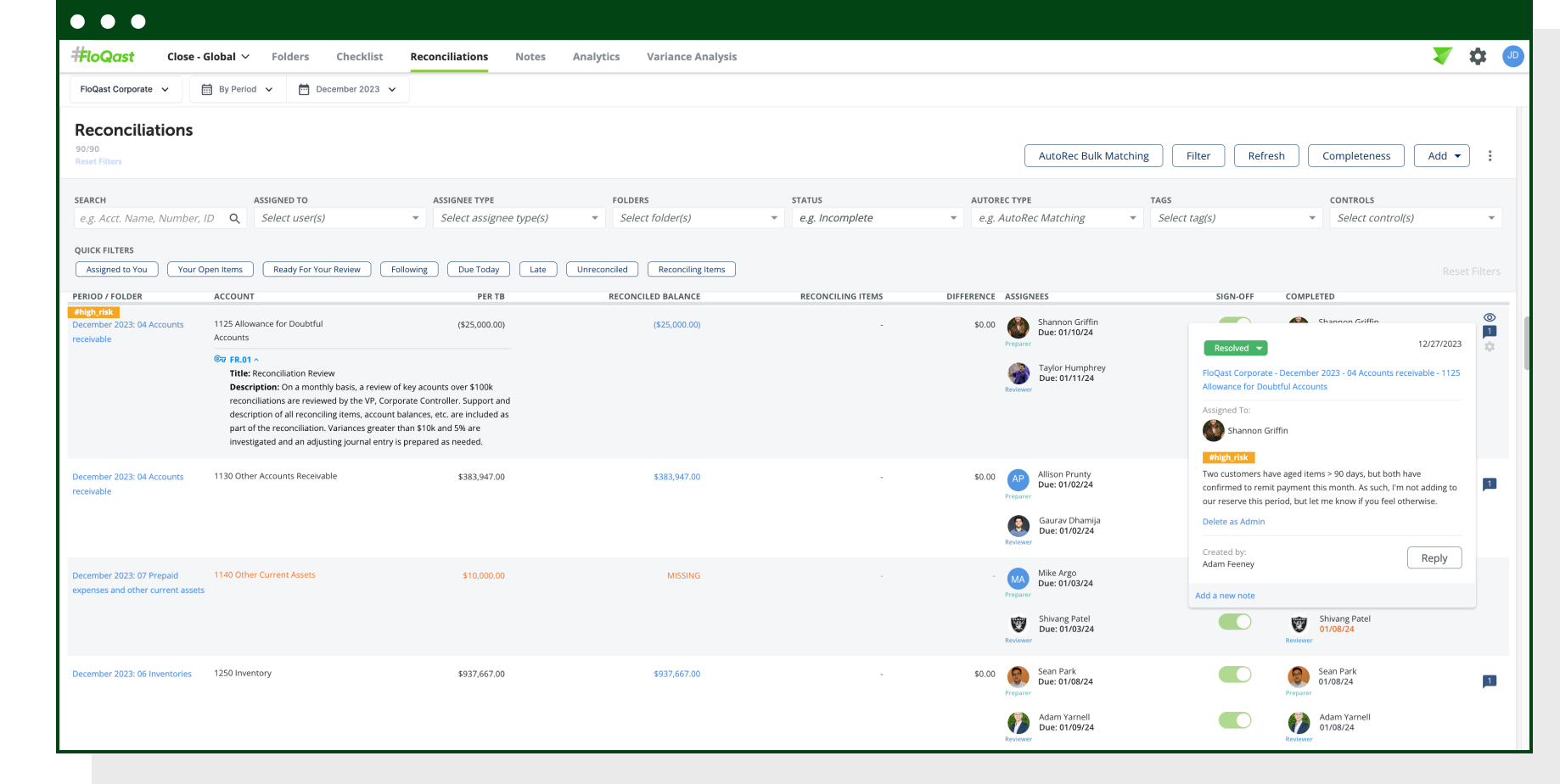

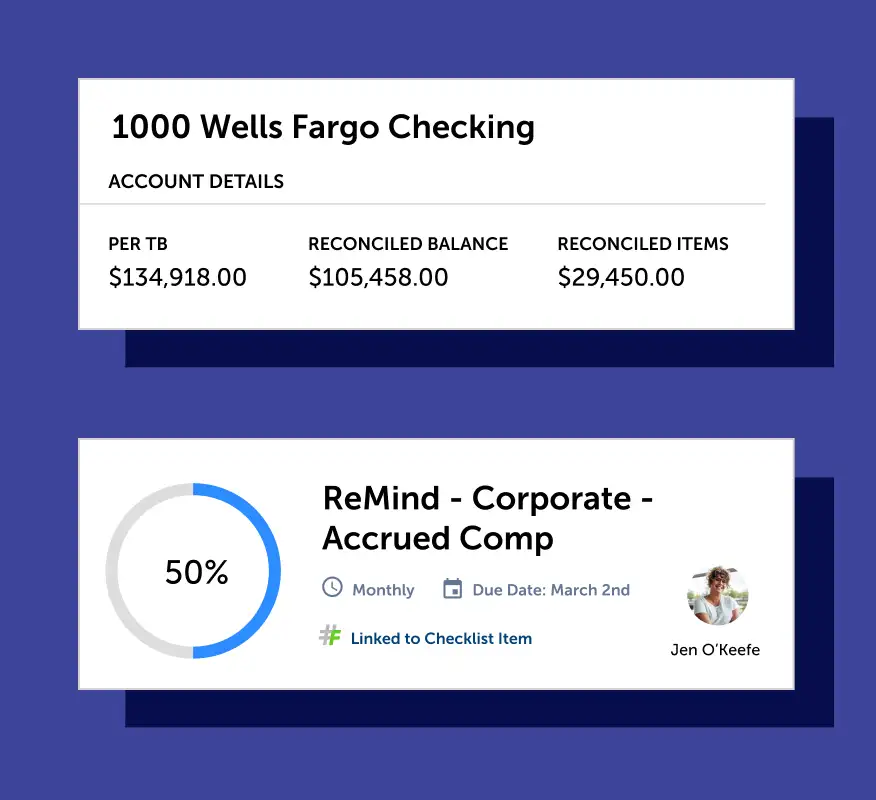

Manage All Reconciliations in One Place

FloQast Reconciliation Management provides a single dashboard to monitor reconciliations in real time. See a quick summary or dive into the details, check the status of your reconciliations, and understand the impact on your Financial Close.