Blog - accounting

Accounting

What Is a General Ledger Reconciliation?

A general ledger reconciliation is an activity performed by accountants to verify that information in the general ledger is accurate. Most accountants perform general ledger reconciliations during the:

…processes to help make sure their financial reports are sound. If they find discrepancies in the general ledger, they can more easily track where the problem originated than if they attempted to reconcile the balance sheet or income statement.

But let’s back up a moment and learn more about what the general ledger is and how a business uses it.

What Is a General Ledger?

A general ledger (GL) keeps a record of a company’s financial transactions. The ledger itself is organized into accounts where financial transactions accumulate. Financial accounts are grouped into the following five categories:

- Assets

- Liabilities

- Equity

- Income

- Expenses

These accounts can be further categorized into subledgers to whatever degree your company wants. The more accounts or subsidiary ledgers you have, the more granular your raw data will be.

How Are General Ledgers Used?

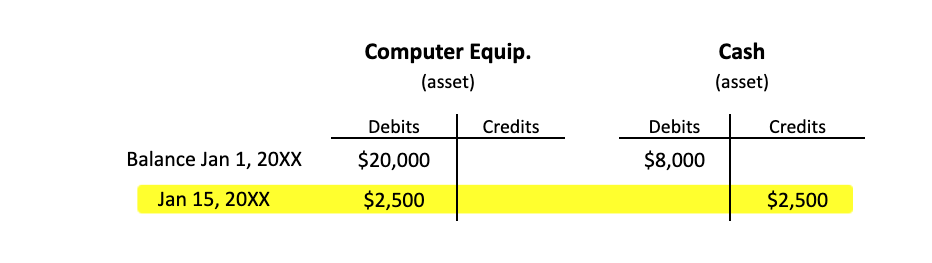

Under the double-entry system of accounting, every financial transaction will be posted to two (or more) GL accounts. One side of the entry will be a debit, and one side will be a credit. For example, let’s say you purchased computer equipment for $2,500 with cash on January 15th. Your debit would be to the account titled computer equipment to show that you increased your assets, and your credit would be to your cash account to show that you decreased your cash reserves.

If you did the general ledger entry by hand, it would look like this:

Today, most GL systems are computerized, so you won’t see your entries laid out in a T-account like this. But understanding how a T-account works can help you see how transactions net with each other and how general ledger balances accumulate.

To continue with the example from above, let’s say on January 21st, you purchased $3,000 of computer equipment and $50 of office supplies with cash. These were your only transactions for January. This is what your general ledger accounts would look like when you closed them out at the end of the month:

What Is the Difference Between a Balance Sheet and a General Ledger?

The general ledger isn’t an official report; it’s the raw data that accountants use to generate official reports. At the end of your accounting period, the information in your general ledger will be grouped, consolidated, and organized to create internal reports (like trial balances) and external reports (like balance sheets, income statements, and statements of cash flow).

How Do You Perform a General Ledger Reconciliation?

When you reconcile the general ledger, your goal is to verify and finalize your account balances. Most accountants do this by performing the following steps:

Step 1: Input Data

Ensure all your financial data has been entered into your general ledger through the financial close. When you do this, be familiar with your company’s reconciliation policies. For example, you’ll need to know how often your company records asset depreciation or when you should break out credit card purchases into their individual expense accounts. This bookkeeping task should be done regularly, not just at month-end.

Step 2: Verify Ending Balances

There are many ways to verify balances, but a standard method compares your account balance to a third-party statement like a bank account statement or a mortgage statement. For example, if you wanted to verify your cash account, you could compare your cash account balance to your month-end bank statement.

You can also cross-check your balances with other source documents like invoices, receipts, or subledgers that have already been reconciled against individual transactions. (We discuss reconciliation tactics like these in more detail later on.)

Step 3: Investigate Discrepancies

If there is a discrepancy, dig deeper to see where it originated. You may need to look at individual transactions to see where the error occurred.

Step 4: Post Adjusting Journal Entries

If you discover any discrepancies, you can post a journal entry to correct those mistakes.

Performing GL reconciliations regularly (monthly, quarterly, or annually) helps you catch errors before they get out of hand. Even minor errors can accumulate and contribute to a material misstatement if you fail to address them before the year is out.

What Are the Main Types of Reconciliations?

In Step 2 of the general ledger reconciliation process, we hinted at a few ways you can verify account balances. Let’s explore these methods in a bit more detail. Four of the most common types of reconciliations are:

Bank Reconciliations

A business performs a bank reconciliation when they tie their activity to their bank statement. This could also apply to credit card statements, mortgage statements, loan statements, investment reports, and other third-party reports.

Customer Reconciliations

You can also verify account balances with your customers. You can review what you’ve been billing the customer and compare those balances to your GL’s outstanding accounts receivable balance. Alternatively, you could ask your customers to confirm their balance.

Vendor Reconciliations

You can request reports or recent invoices from your vendors to see if your accounts payable balance matches their records.

Comparing Beginning and Ending Account Balances

There will be some accounts (like most expense accounts) where you have no external report that can confirm your ending balance. You can look at your account variance in these instances, i.e., the difference between the beginning and ending balances. If your monthly activity matches the monthly account variance (and if you started off with an accurate beginning balance), you can be confident that your ending balance is accurate.

There is no one right way to reconcile your accounts. Businesses should select the process that works best for them and continue to perform that process the same way every month. If you aren’t sure where to begin, you can start using account reconciliation software. Reconciliation software automatically performs large portions of basic account reconciliations for you so that you can spend your time investigating discrepancies or making proactive business decisions.

Common Errors During a General Ledger Reconciliation?

Reconciling all your accounts may take some getting used to, but once you have a process in place, it should go more smoothly with each passing month. Here are a few things you’ll need to watch out for when performing monthly, quarterly, or annual GL reconciliations.

Late or Missed Reconciliations

It’s not the end of the world if you finalize your reconciliation a few days behind schedule, but if you do, make sure you are looking at the right reports. Most accounting software will let you set the period you want to view. Make sure you are only looking at the information through a specific date; you don’t want to review the information that has been posted after the financial reporting period has ended.

Journal Entry Errors

Anytime you make a manual entry to your general ledger, there’s a possibility that you’ll make an error. You may, for example, post a debit rather than a credit, or you may transpose a set of numbers. These accidents are unavoidable — we are human, after all — so you should be on the lookout for simple mistakes like this when reconciling your accounts.

Duplicate Entries

Duplicating entries happens most often when company policies aren’t set or those accounting policies aren’t followed. Make sure each team member understands their role so that two people aren’t posting the same entry. If your accounting software posts an entry automatically (like it may do for depreciation or certain accruals), manually review those entries to verify they are correct and haven’t been posted twice.

Incorrect Coding

When using accounting software, you often post to an account by referencing its account number rather than its account name. If you accidentally post to the wrong account, more than just one account will be off in your reconciliation.

Why Should You Perform GL Reconciliations?

Performing GL reconciliations isn’t optional. If you want to improve the financial health of your business, GL reconciliations are an absolute necessity. Not only will reconciliations approve the accuracy of your financials, but they can also help prevent errors from occurring. And when your leadership has error-free and up-to-date information, they’ll make better decisions.