Blog - Remote Work

Webinar

Embracing the New Norm — Establishing and Optimizing the Effectiveness of Virtual Finance & Accounting Teams

As the COVID-19 pandemic continues its vice-like grip on, well, everything, businesses continue to cope as best they can.

Particularly hard hit during the insanity are finance and accounting teams. Long accustomed to working in highly-structured environments, many teams are struggling to adapt to a suddenly-remote job.

Recently, FloQast Co-founder and CEO Mike Whitmire and Kranz Associates CFO Andrea Tiller hosted a webinar with veteran accounting leaders to discuss remote work struggles, best practices for managing teams in a highly stressful time, and how they’re adapting on the fly. Here are some of the key tips and strategies guests shared about running a successful virtual finance and accounting team:

The Art of Communication: Clear Dialogue Dictates Success

Team communication has shifted in a huge way. Meetings have gone virtual, and what once would’ve been communicated face-to-face is now a series of Slacks, emails, and IMs (or you can go for the hat trick and send the same message on all three channels at once, just in case ).

What can you do to keep your communication clear and efficient?

“Some of our processes are pretty well defined, like the monthly close,” said Judy Kopa, CFO of Gigster. “That work seems to go pretty smoothly. But if the finance/accounting team is working on any special projects that require agile brainstorming discussions, then working from home all of a sudden becomes quite restrictive.

We’ve learned to be really clear on what we meet about and how we conduct the discussion. Is this the meeting where we’re going to share information versus, ‘Hey, here’s a brainstorming session where we want to pull everybody in to have a creative discussion.’ So I think the agenda and the format of the meeting are really important.”

This is one area where proactive companies may actually come out better when this is all over. The right meetings, at the right time, with the right people, can communicate so much more effectively than endless meetings with everyone in the building.

Jerry Raphael, CFO at Stack Overflow, added “What I’ve done is just put a quick 10- to 15-minute meeting on the calendar to go through any quick questions folks have. It just helps us avoid the random emails and Slack messages that could get in the way of you putting your head down and really focusing and banging out work when you’re going through the [quarterly] close.”

Depending on what your team is up to, you’ll need to adjust how frequently you meet and how many people need to participate in those meetings. A quick check-in to touch base and cover questions can save a lot of distracting and time-consuming communications later in the day.

Collaboration is Key: How Teams Can Organize Processes and Responsibilities

Teams are all about working together, but it’s easy for collaboration to suffer when we all work from our own little sweatpants bubble. How can you keep processes running smoothly, and keep an eye on accountability? Collaboration tools can help.

Before that, however, a few things need to be taken into consideration. For one: Is everyone on the team comfortable with the technology they’re using?

“You want to be sure that your people are technologically comfortable, that they’re comfortable using the tools,” said Tiller. “I think there’s a leadership responsibility that, if not all of your people are technologically comfortable, you need to provide that additional support and that additional training to make sure that everybody is able to access those tools.”

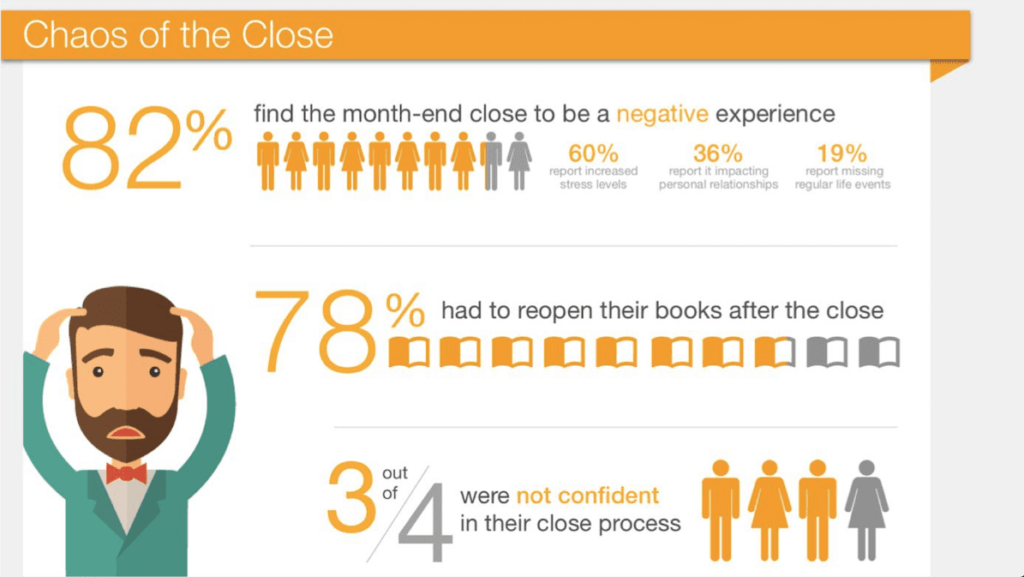

One common situation where collaboration is key for accounting teams is the monthly close. Documenting your progress and getting the required sign-offs can be more challenging when you’re working remotely.

“One thing that’s really cool about FloQast is you’re really able to see what everyone is working on, see their progress with the close, and it helps you to keep everybody accountable,” Jerry said. “The whole team keeps each other accountable because there are all these interdependencies as you go through the close. We are able to document who prepared a specific reconciliation or work paper. And then there’s also a place to actually record the approver. It actually stamps the action with a time, date, and signature that you could even give to an auditor so they have examples of existing processes.”

Embracing the New Norm: How to Maintain Company Culture Remotely

In the webinar, 30% of participants reported participating in a weekly “virtual happy hour” to help the team stay connected and keep the culture strong. What else can you do to maintain a healthy culture with your remote team?

- Use virtual communication tools for social connection, not just work. It could be that virtual happy hour or a channel in Slack for personal posts. At FloQast, we have a channel for everyone to share pictures of their dogs. Man needs a best friend, now more than ever.

- Give people room to be real. With everyone working from home, personal life is going to bleed through. Every video conference is inviting people into your personal home. Kids, pets, and messy bedrooms are the new backdrop (unless you use one of those cool Zoom background images). Make sure your team knows it’s okay to be real. We’re all in this together.

- Make sure your team knows you’re there for them. It can be easy to hide out on a video conference call, especially if everyone is talking at the same time. One-on-one calls and a virtual “open door policy” can help your team members know they’re not alone, and give them a space to voice any concerns safely.

How has your team adapted to remote work during the COVID-19 crisis? What lessons will you bring with you once the crisis is over?