Blog -

Company News

Close Analytics and the Many Moving Parts of the Close

Here’s a not-so-random thought: did you ever wonder what it’s like to be the Fed Chairman?

That job sounds pretty hectic. You hold sway over interest rates, which drives the cost of loans and value of bank deposits, which impacts propensity to spend or save, and ultimately balances economic growth vs. inflation. It’s a heavy responsibility with a lot of interlocking pieces.

And despite the complexity, what the world wants most from you is a top-level summation: Are we doing well or facing problems?

Sound familiar? It’s a lot like managing the close process – albeit a little less lofty.

As controller, you must channel your inner Janet Yellen

The Controller’s Challenge

The controller’s task is two-fold: manage the many moving parts of the close process, and repeatedly answer a seemingly simple but devilishly complex question: are we on track and when will we close?

It was with that controller’s challenge in mind that FloQast first released Close Analytics in Spring 2017. We wanted to help teams visualize the close process, and isolate elements to focus on for improvement. And we did.

But there were still more opportunities for FloQast to give controllers better tools to manage the interlocking puzzle pieces of the close. So we set out to create the new and improved version of Close Analytics.

Our key insight: there’s as much need to provide greater clarity on the current close as there is to help teams understand their close trends and clues to improving over time.

In fact, for some teams, the energy expended on any one close is so great that they don’t have the time to review, reflect and hone their process. More to the point, any insights we delivered had to be mindful of our users’ most precious asset – their time. Our solution had to provide insights at a glance, with an ability to quickly scan for deeper understanding, and to quickly identify where to step in to fix things.

The new version of Close Analytics creates that at-a-glance visibility, revealing with greater clarity how an accounting team works through the many deadlines set for each task – be it the current close or any prior version.

Our hope is that accounting teams consult Close Analytics at least daily throughout the close process – and often for a retrospective view between closes – because it’s the most informative quick take on how the work is going. Plus, it’s the best way to confidently answer that most-asked question: how is the close progressing?

The Close Pace Line

The biggest change is that we’ve introduced the concept of ‘pace’ to monitoring the close. Pace refers to the cumulative number of tasks that should be done after each day of the close, based on the due dates set in FloQast. Tracing actual progress vs. pace reveals whether the team is ahead or behind the pace of completing tasks that’s required to close on time – all understood at a glance.

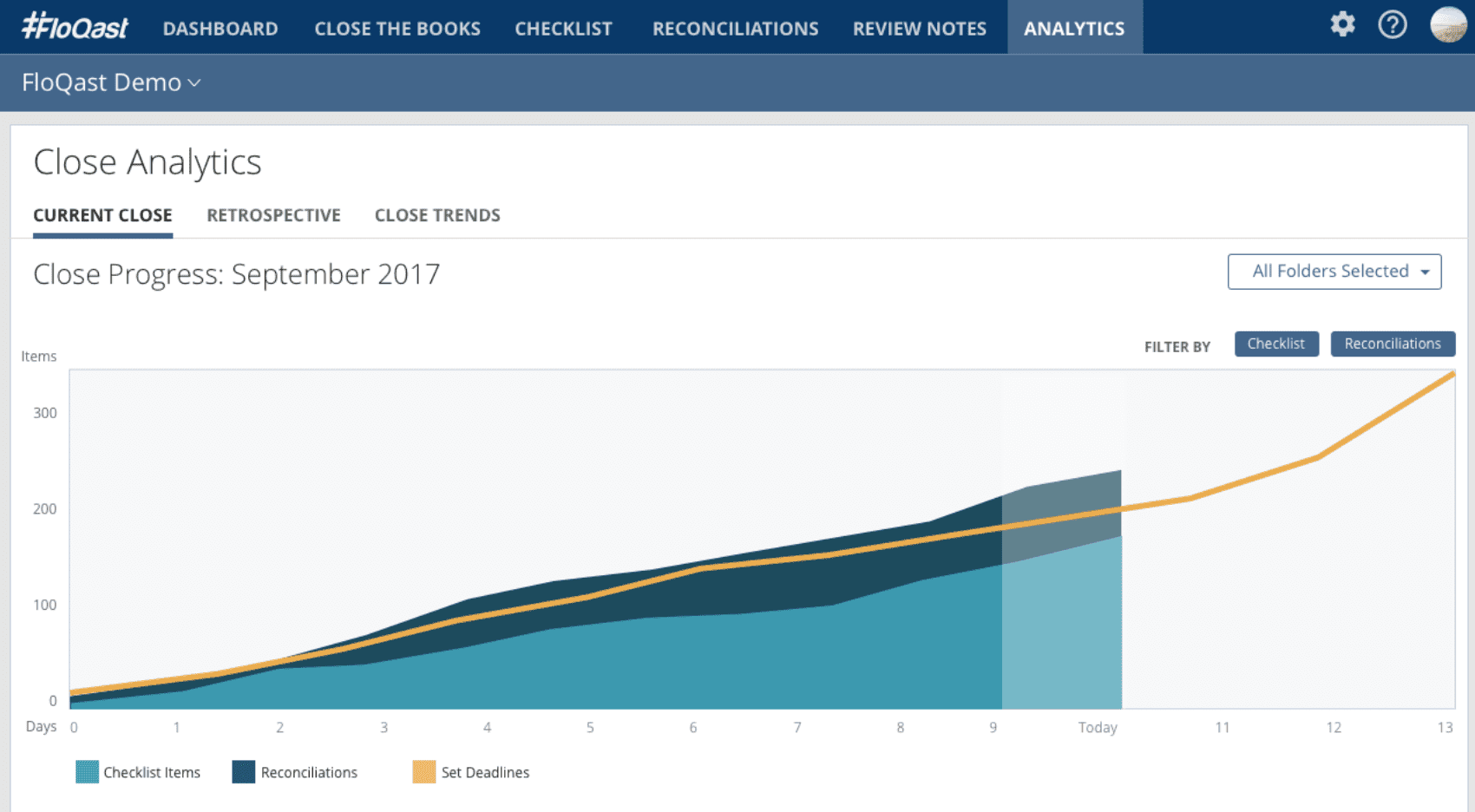

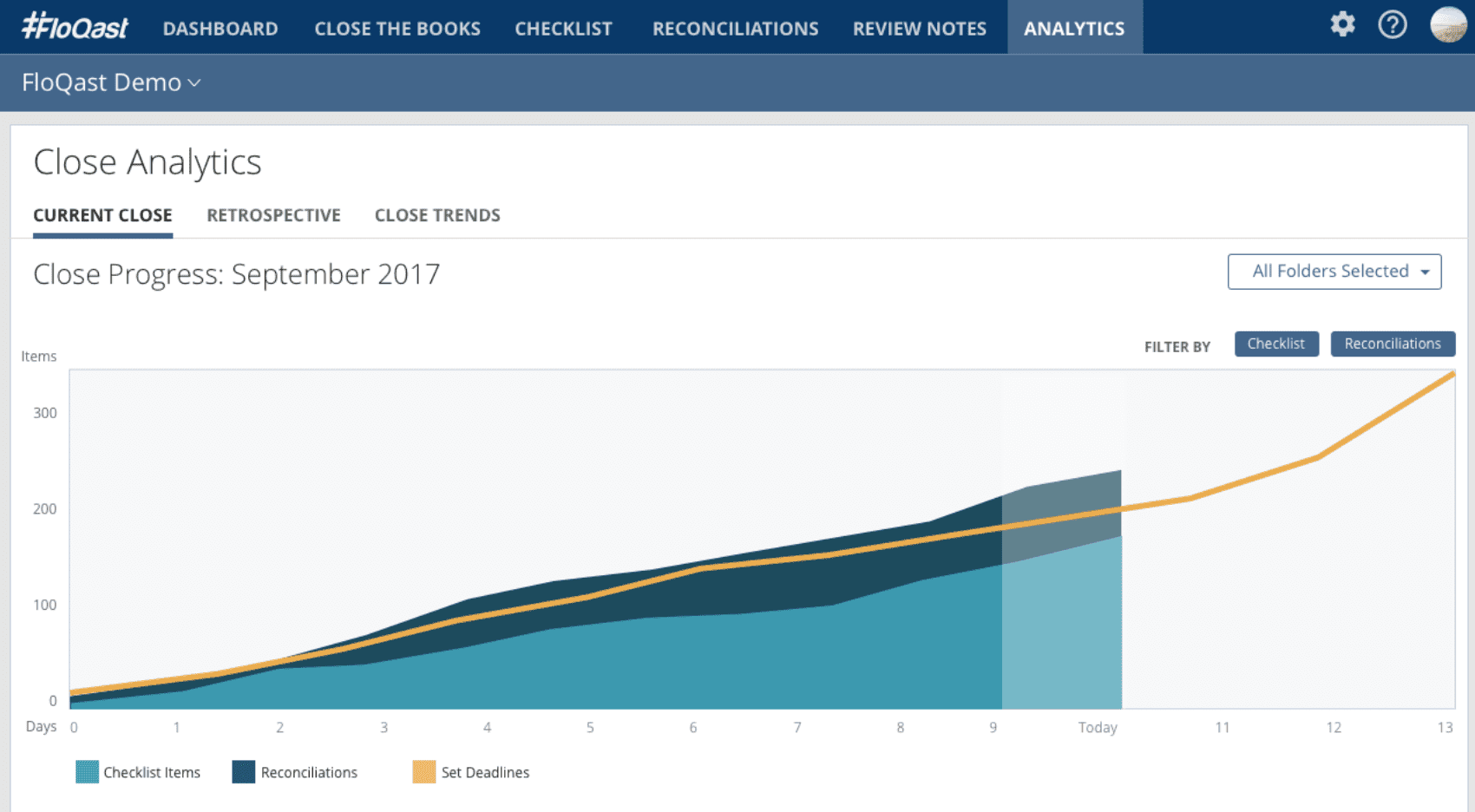

You can see how that looks in the view below. The visualization includes a gold pace line, which we call ‘Set Deadlines’. Completed checklist and reconciliation tasks are represented by the turquoise and blue shaded area.

When the team is ahead of pace, the turquoise and blue shade extends above the gold pace line. If the team is behind, the turquoise and blue sits below the pace line.

So when the controller must answer with confidence whether the team is ahead or behind schedule to finish on time, the answer is clear to see and report to whomever is asking.

From there, it’s easy to scan for greater details about ‘why’ the team is ahead or behind pace, and uncover the clues to what to do about it – either for the current close or by reviewing common themes from prior closes.

There’s plenty more to the new Close Analytics. Users who already are already familiar with it will notice that the layout is simplified even though the power to gain insights has increased. Those new to Close Analytics will see how easy it is to learn and use.

If you’d like to see firsthand how FloQast can help you get a better handle on your company’s close process, sign up for a free one-on-one demo.

You might find you’ve got more in common with the Fed Chairman than you think.