Outsourced Advisory Services

FloQast is a purpose-built Accounting Transformation Platform built by accountants for accountants. Collaborate seamlessly while optimizing, automating, and providing visibility into key processes across entire client portfolios.

FloQast for Client Accounting Services

Automate manual tasks and reconciliations. Build scalable process strategies. Do it all with FloQast.

Organize and Automate

Your unified, automated platform for efficient task management across teams, segments, and clients.

Exceed Client Expectations

Standardize the close, boost productivity, and enable your teams to focus on high-value client services.

Simplify Team Communication

Keep all your documentation and data in one place with easy access for everyone who needs it.

Automate and Centralize Your Accounting Operations

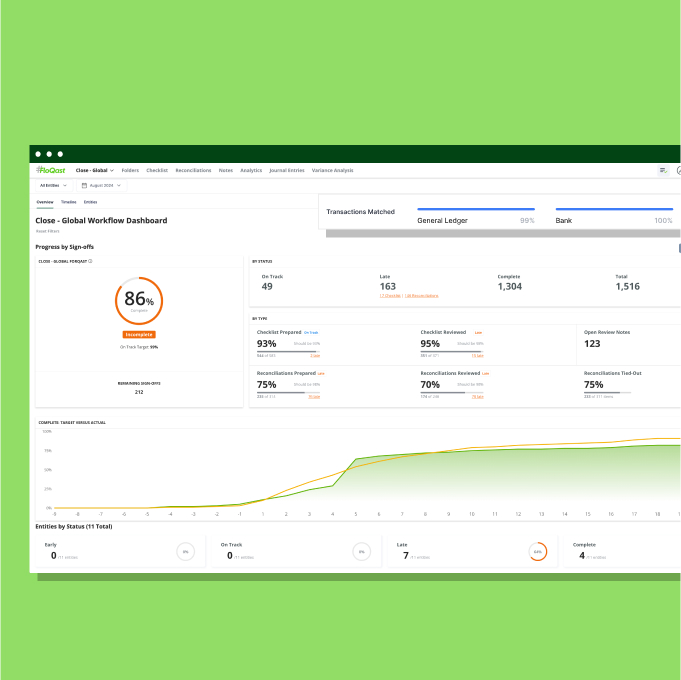

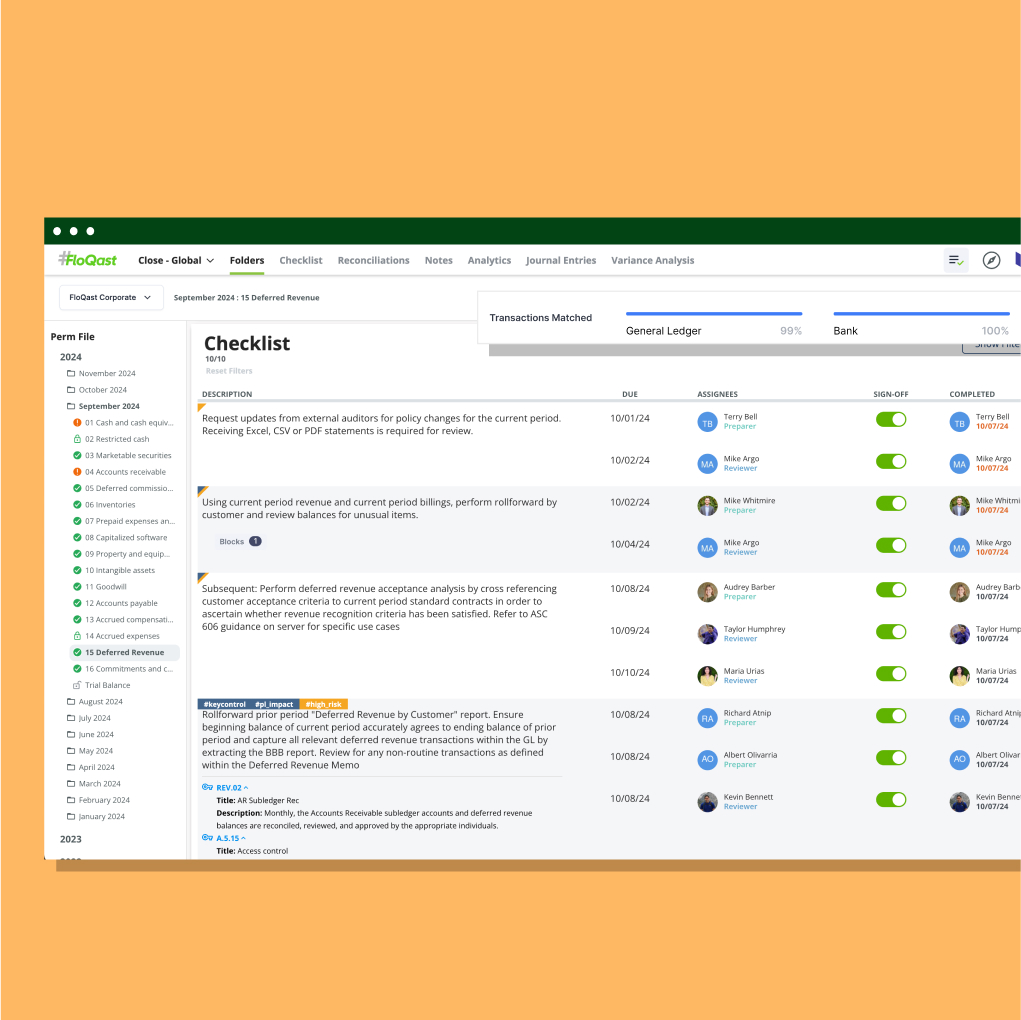

Workflow Management Visibility

Gain full visibility into task and workflow management across multiple teams, segments, and clients through a single Accounting Transformation Platform. FloQast streamlines operations and enhances communication, ensuring all regional offices and teams work together efficiently.

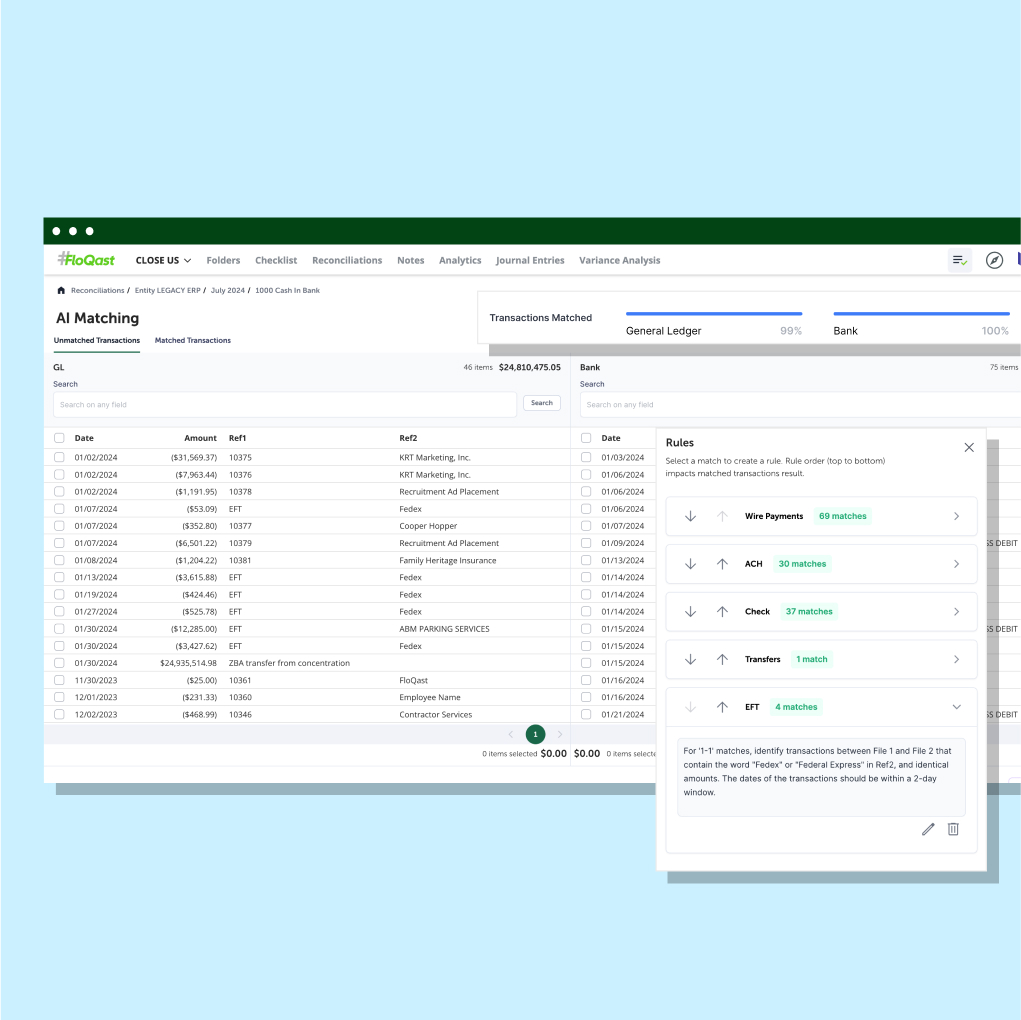

Process Standardization and Consistency

Standardize the close for better team productivity. Free up more time for advisory growth, allowing your teams to focus on delivering high-value client services. FloQast’s automation and efficiency tools, like AI Matching and ReMind, boost productivity and save time.

Centralized Documentation and Communication

Centralize all supporting documentation, workbooks, and internal communication, ensuring all relevant information is organized and easy to find. This leads to smoother, more efficient workflows that reduce guesswork and standardize processes across the board.

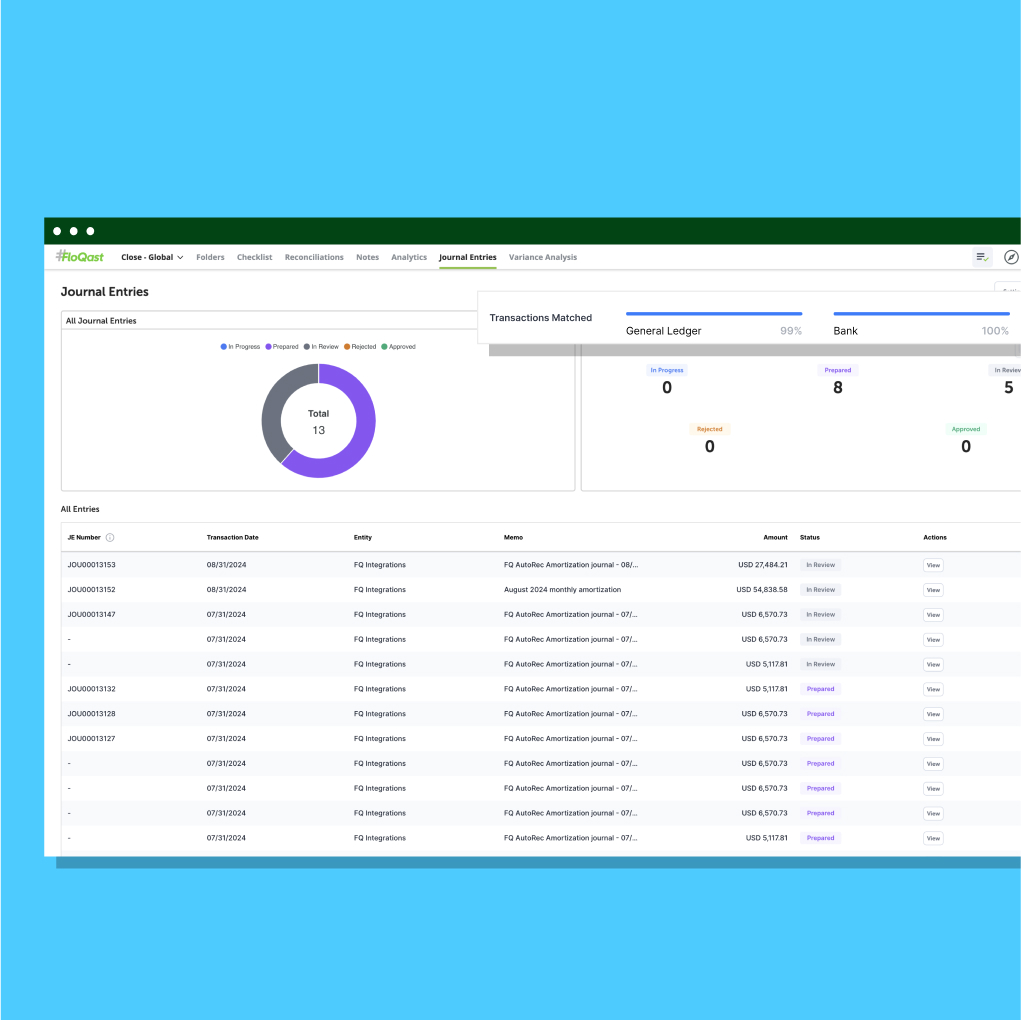

Efficiency Gains Using System Integrations and Resource Allocation

Benefit from direct ERP & API integrations tailored to meet your needs. These integrations automate routine tasks, reduce manual work, and give teams more time to focus on strategic activities. FloQast’s automation capabilities help teams maintain consistency and efficiency while identifying where to allocate resources.

Use Case Companies

“We were looking for a command center we could use to track tasks across our top 1,000 plus clients in our CAS practice, across all of our regional offices. We pride ourselves on an integrated service approach, working collaboratively and transparently, and FloQast has made that happen for us.”Sharon Berman, CPA, CGMA

Principal and Business Advisor