If this is your first time performing a financial statement audit, you may have been asked to prepare a “PBC Request List” or “Audit Request List.”

You may wonder what a PBC List is and what you need to include on that list.

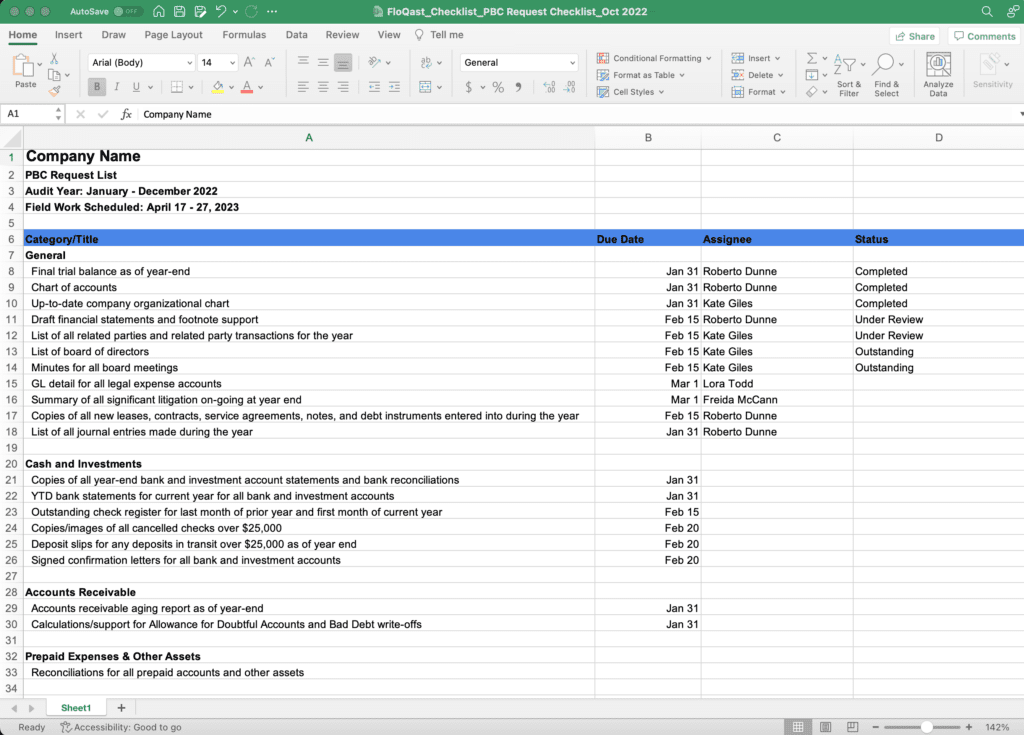

Don’t worry; we’ve got you. Here’s a simple explanation of what a PBC Checklist is and why it’s an essential part of getting ready for the annual audit. Plus, we’ve even included our own downloadable PBC Checklist that you can customize as necessary for your first financial audit.

What Is a PBC Request List or PBC List?

The acronym PBC stands for “Prepared by Client” or “Provided by Client.” In no time, you’ll be intimately familiar with this term, as it will be stamped or indicated all over your audit workpapers, wherever information has been—you guessed it—provided by the client.

An audit PBC List is simply a list of requested items that the auditors need from the client to plan the audit, evaluate internal controls, and begin fieldwork.

External auditors send an initial PBC Llist to the client early in the audit preparation or planning phase. However, they can and should add new requests to the list as the audit progresses.

What Is the Purpose of a PBC Request List?

The purpose of an audit PBC Llist is to communicate to the client all the information and documents the auditing firm needs to plan and perform the audit.

Rather than asking for items one by one, auditors compile a master list of all the necessary documents and share it with the client’s accounting team.

Which Items Should be Included in a PBC List?

The specific documents included in a PBC Request List vary depending on the type of audit and business being audited. However, the following list can be a great starting place to help you formulate your client list.

- Trial balance

- Balance sheet

- Income statement

- Statement of cash flows

- Copies of bank statements and reconciliations

- A list of all deposits for the three months following the end of the year

- An accounts receivable aging report as of the year-end, reconciled to the balance sheet

- An analysis of the allowance for doubtful accounts

- Schedules for all prepaid accounts

- Detailed inventory listings that tie to the general ledger

- A fixed asset schedule and depreciation schedule

- Fixed asset additions and disposals during the year

- An accounts payable aging report as of the year-end, reconciled to the balance sheet

- A schedule of checks written from year-end to the date of audit fieldwork

- Schedules for all accruals as of the year-end

- Copies of debt agreements

- Amortization schedules for any outstanding notes or loans payable

- A list of current board members

- Copies of all board minutes for the year under audit

- Annual budgets

- A company organizational chart

- A list of all related parties

- Copies of all contracts, leases, and other agreements

How Are PBC Lists Formatted?

A PBC Request Llist can take many forms. It might be in a Word document or an Excel spreadsheet. Or your audit team might use software to automate and streamline the audit checklist.

Whatever the format, CPAs typically organize the client PBC List by categorizing requested items into categories based on the financial statement presentation, such as general items, cash and cash equivalents, accounts receivable, prepaid expenses, fixed assets, and so on.

It’s also helpful to include due dates for each specific item on the list, so clients know what is expected and when. For example, auditors need the trial balance as soon as possible to start planning the audit, so you might want to set a due date for the trial balance of 30 to 60 days before the start of fieldwork. Other areas come up later in the auditing process, so auditors might not need certain documents until later.

Send your PBC Llist immediately after the client’s fiscal year-end. That way, as they’re closing the books and reconciling accounts, they can start gathering the documentation you need.

Download FloQast’s PBC Checklist

All of the above is a preview of our PBC List template, built from our collective expertise in helping hundreds of companies streamline and organize their month-end close and financial reporting processes.

Download a free copy of the Excel template below and customize it as you see fit. It’s an easy way to build out your list of required information for the annual audit. Happy auditing!