FloQast Reconciliation Management

Don’t Sweat Your Recs

End-to-End Reconciliation Management

Does the Heavy Lifting For You

FloQast Reconciliation Management is an advanced workflow solution that works with FloQast Close to deliver end-to-end account reconciliation management and AI-enhanced automation. Increase your financial velocity and accuracy of the Financial Close while reducing the risk of misstatement.

FloQast Reconciliation Management

FloQast Reconciliation Management allows accounting teams to manage and automate the end-to-end reconciliation process with a centralized solution trusted by accountants and auditors worldwide.

Optimize the Reconciliation Strategy and Process

Select an approach that will best address the risks unique to each balance sheet account and best practices to ensure consistency and continuity as your organization scales.

AI-Assisted Automation

Some processes make sense to automate with AI-enhanced machine learning models to minimize human error, while others require manual – but efficient – management. FloQast Reconciliation Management lets you choose the best method for your organization.

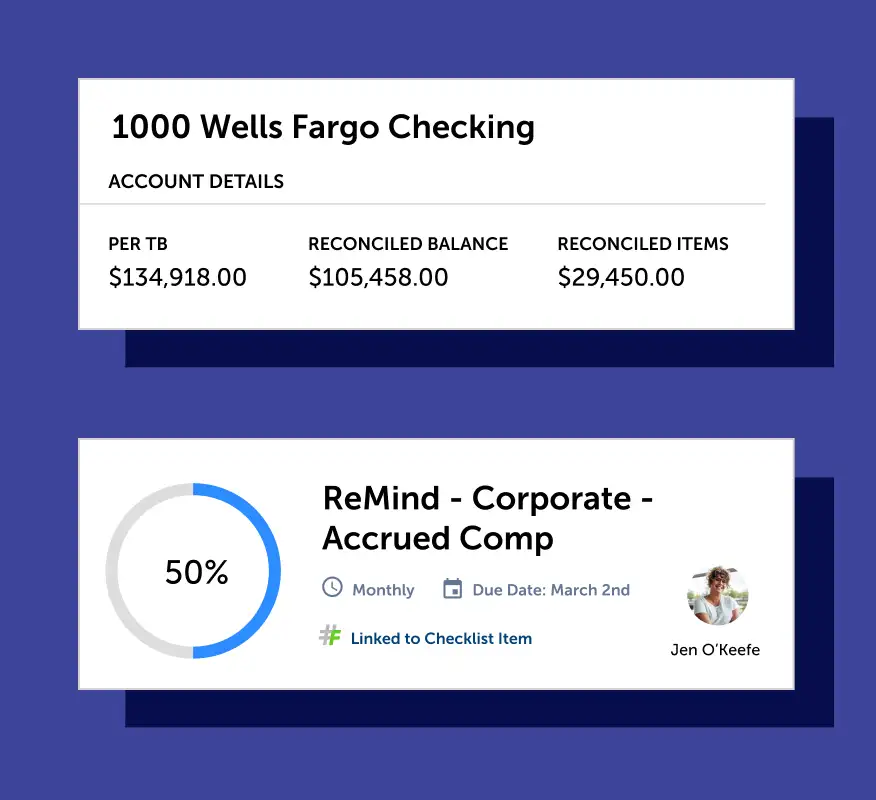

Manage All Reconciliations in One Place

FloQast Reconciliation Management provides a single dashboard to monitor reconciliations in real time. See a quick summary or dive into the details, check the status of your reconciliations, and understand the impact on your Financial Close.

Get a Sneak Peak of Reconciliation Management

Explore FloQast Reconciliation Management

Centralized View

AI Enhanced AutoRec Matching

AutoRec Schedules

Built-in Controls

Integrated Reconciliations

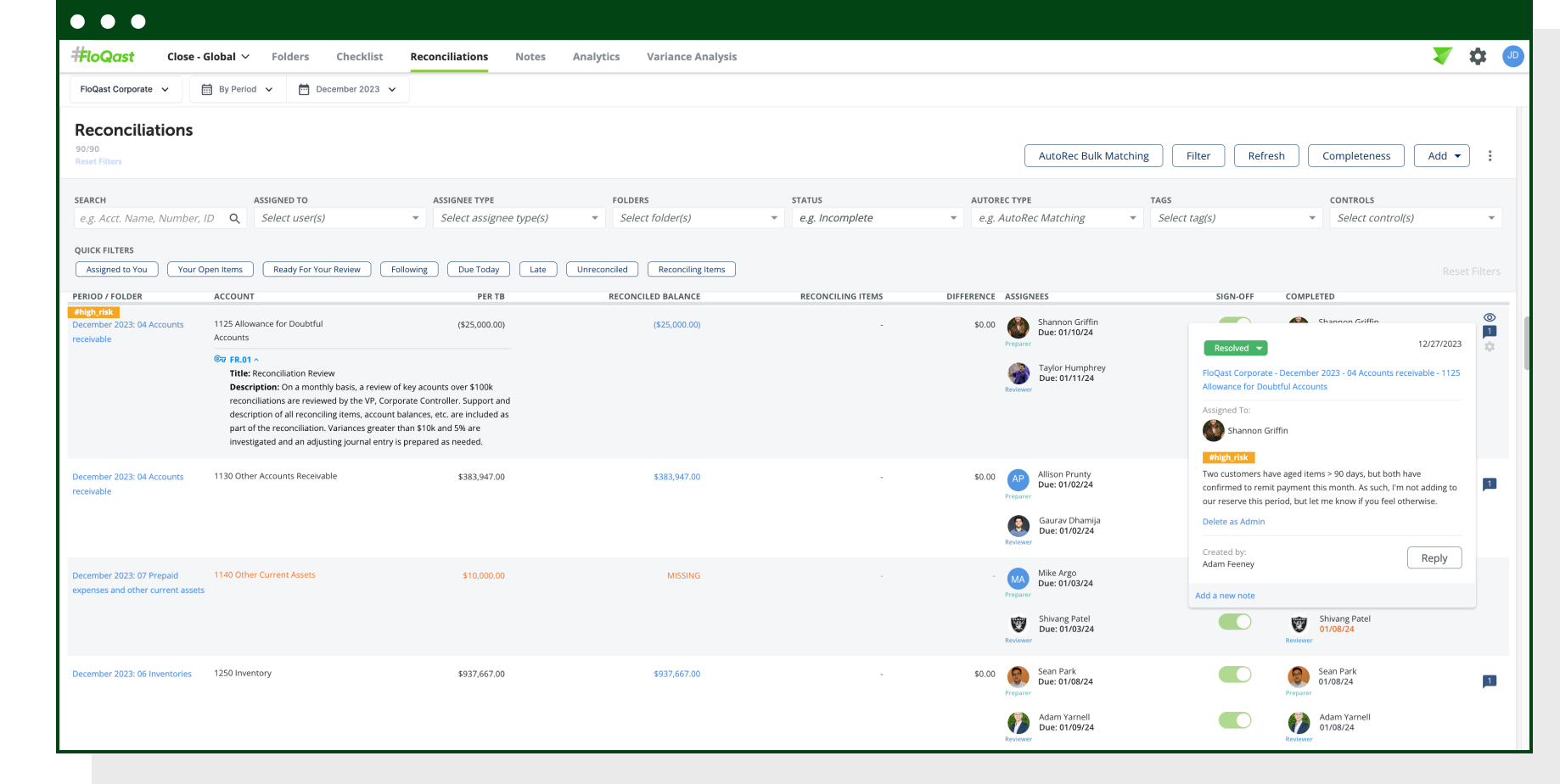

Centralized View

Reconciliation Tie-Outs give accountants a centralized view of the reconciliation status for each account with balance comparisons, preparers, reviewers, reconciling items, and sign-off dates. Dashboards offer insightful real-time status from individual reconciliations to a consolidated view. Ensure accurate reconciliations with automatic notifications on upcoming due dates and when reconciliations have gone out of balance.

Download the Data Sheet

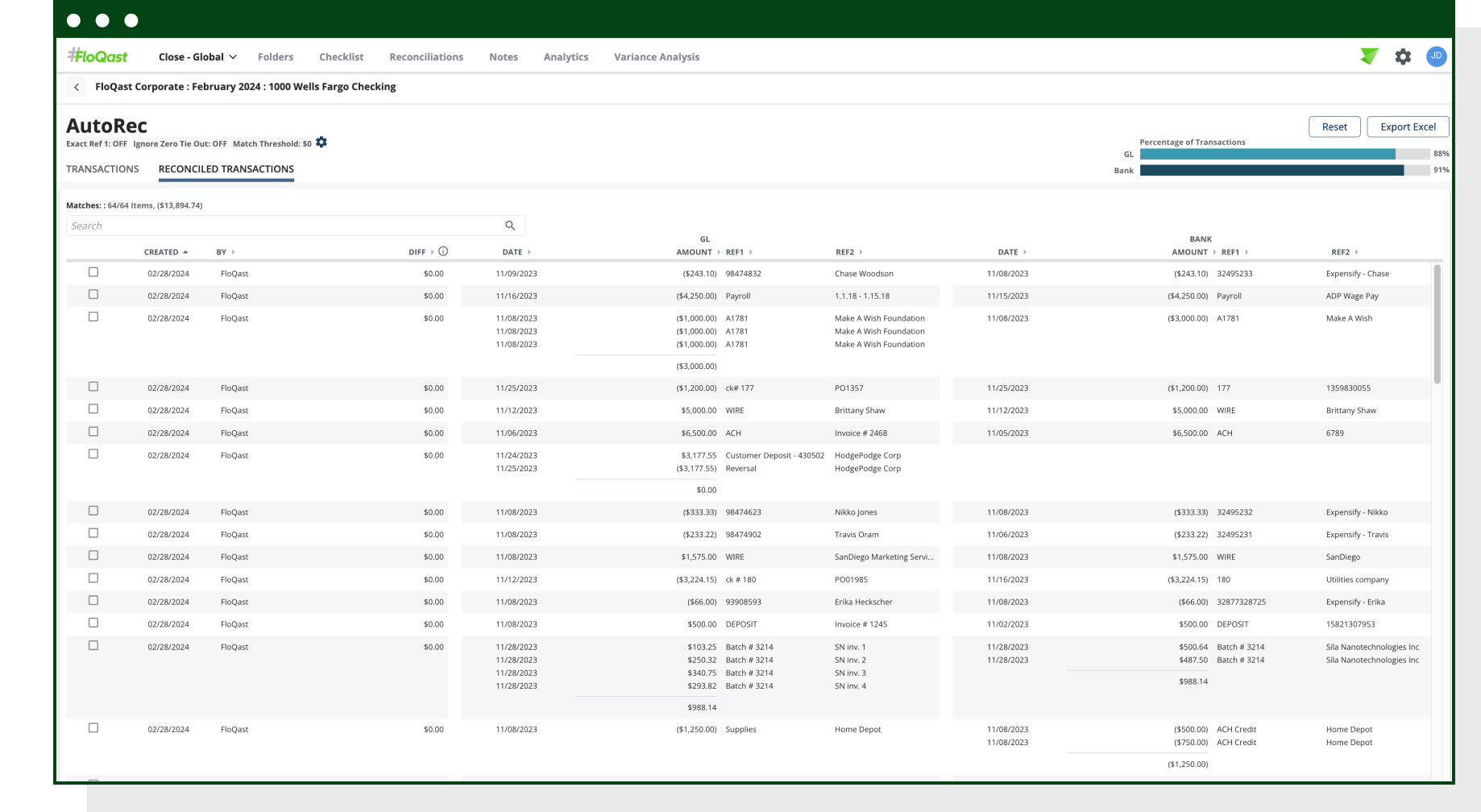

AI Enhanced AutoRec Matching

Leverage AI and transform reconciliation processes by matching thousands of transactions within minutes. Unlike rule-based models restricted by predefined criteria, AutoRec Matching leverages a machine-learning model that analyzes transactions between two datasets and identifies matches. Now, organizations can achieve unparalleled efficiency and minimize human error in reconciliation workflows across various use cases, such as bank reconciliations, intercompany accounts, and subledger reconciliations.

Download the Data Sheet

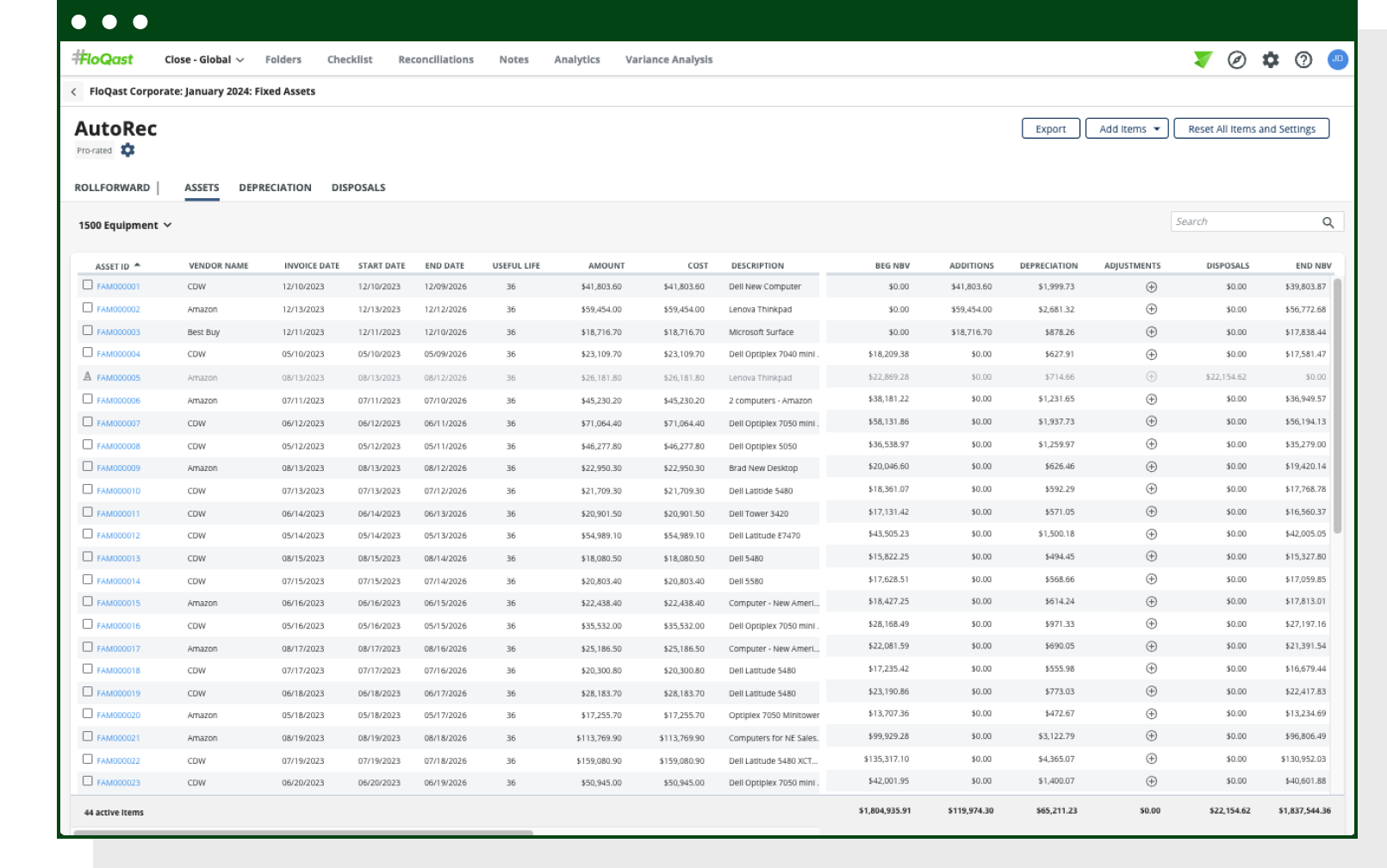

AutoRec Schedules

AutoRec Amortization and Depreciation set up end-to-end reconciliations for intangible assets, like prepaid accounts and fixed assets, with automated schedules and journal entries pushed to ERPs. Understand how each item is being amortized or depreciated and link supporting documentation directly to the source. Easily edit and preview your changes as needed and automate supporting schedules for reporting with roll forwards and waterfall schedules.

Download the Data Sheet

Built-in Controls

Enhance your organization’s control environment with purpose-built controls, including materiality thresholds, centralized reconciling item tracking, and strict signoff modes, ensuring proper separation of duties. Once reconciliations are complete, users can lock folders to protect the data integrity of files and automatically roll forward all folders and schedules when your team is ready to close the next period.

Download the Data Sheet

Integrated Reconciliations

Implement a reconciliation solution that seamlessly integrates into your existing solutions, tools, and processes. FloQast is ERP agnostic and automatically pulls in account balances, even if you have multiple ERPs. Integrations to cloud storage providers and spreadsheets allow teams to continue using existing tools where it makes sense. Need to see the details to perform subledger reconciliations? FloQast Subledger API pulls transactional data from third-party solutions and ERPs.

Download the Data Sheet

“I saved so much time with AutoRec by not having to do all of the manual keying and manipulation with Excel. The transactions that match up automatically are set aside and I don’t even have to look at them. It gives me more time to focus on other issues or things that might take longer.”Cassie Blubaugh

GL Accountant

Trusted by:

Reconciliation Management Use Cases

For the Controller

See the reconciliation status of each account instantly. Help automate the tedious reconciliation process with AI so you can focus on process improvements, leading to a smoother and more accurate Close. Feel confident that your team is working more efficiently and accurately with automated processes, including integrating with your ERP.

Learn MoreFor the Accounting Manager

FloQast is your single place to manage all reconciliations. Assign preparers and reviewers to reconciliations, as well as capture sign-off timestamps. Leverage AI to speed up the month-end Close by automatically matching thousands of transactions. Set up automatic amortization and depreciation schedules for prepaid and fixed asset accounts.

Learn MoreFor the Compliance Manager

Gain confidence in your organization’s Close with FloQast, which helps ensure accuracy by sending notifications when the platform detects an unexpected out-of-balance condition and organizes PBC records on behalf of your team. Leverage AI and countless other purpose-built controls to automate the reconciliation process.

Learn MoreExperience the Power of Accounting Operational Excellence

Unlock more value from your FloQast Reconciliation Management investment with our suite of seamlessly integrated and AI-enhanced accounting solutions.

Elevate Accounting with FloQast AI

Premier Finance and Accounting Operations meets AI with FloQast AI. Teams can implement best practices for processes like the Financial Close, auto-generate Variance Analysis explanations, enhance transaction matching, and automate request management.

Tell The Story with FloQast Variance Analysis

Build a reliable variance analysis into your month-end Close with FloQast Variance Analysis. Assign accounts, set materiality thresholds, and be notified when action is needed. Variance Analysis allows your team to automate fluctuation and budget variance analysis in minutes, not days.

Connect Your Close with FloQast Ops

With FloQast Ops, you can see the status of all accounting operations from upstream workflows like Accounts Payable to downstream workflows like SEC Reporting. This allows greater operational control, improved workload management, and enhanced transparency across all accounting operations.

Learn

Best Practice Reconciliation Templates

Enhance your team's reconciliation efficiency with FloQast's best practice reconciliation templates. Download and implement reconciliation schedules tailored for account areas such as cash, accounts receivable, and deferred revenue to streamline reconciliation processes and ensure accuracy.

Read MoreTry

Demo On-Demand

FloQast Reconciliation Management is an end-to-end advanced workflow solution that allows accounting teams to manage and automate the reconciliation process with a centralized solution trusted by accountants and auditors worldwide.

Watch Video