Blog - BlackLine, excel, Microsoft Excel, spreadsheets

Accounting

Why Excel is Not the Enemy of Accountants

Microsoft Excel sure is catching a lot of flak these days.

Most recently, an article in the Wall Street Journal titled “Stop Using Excel, Finance Chiefs Tell Staff,” cited a number CFOs who say they are ditching the spreadsheet program for financial planning, analysis, and reporting in favor of enterprise software that is a Microsoft Excel alternative.

The argument that Excel is inefficient and obsolete set off a firestorm in the accounting and finance community. One CPA went so far as to reply, “You can have my excel, after you ripped it from my cold, dead hands.”

You can have my excel, after you ripped it from my cold, dead hands.

— Steven Yacht MBA CPA (@SteveYachtCPA) November 29, 2017

To accountants, Excel is life

It’s understandable given how embedded Excel is into the work of most accountants. Across all generations, we can’t imagine life without spreadsheets, or how to even transition from Excel to cloud accounting software.

But that’s why I loved reading Nir Kaissar’s response in support of Excel on Bloomberg, and in particular, this thought:

By requiring users to load and organize data, Excel forces them to make decisions about how to slice and calculate it. Sure, companies can outsource those judgments to specialized software. But by doing so, they’re also outsourcing much of the thinking.

And by design, that thinking isn’t always readily apparent in specialized software. Some critical assumptions and calculations run behind the scenes, forgotten and seldom challenged. Excel, on the other hand, is an open book. There’s nowhere to hide in its iconic cells.

— Nir Kaissar

The beauty of Excel is its openness and flexibility. As Kaissar goes on to say, it’s Excel’s transparency plus the internet that democratized financial analysis in the 90s, allowing a single user anywhere in the world to do the work of dozens of Wall Street Analysis analysts.

The development of computerized spreadsheets had a similarly profound effect on the accounting profession. With the spread of the personal computer into the business world in the 80s, accountants were liberated from their green eyeshades and ten key calculators. Now, a single accountant could do the work of dozens of clerks.

Spreadsheets were such a big deal that VisiCalc spreadsheet for the Apple II is widely considered to be the first example of a “killer app,” an app so powerful that it provides the top justification for buying the hardware. And that value must have been significant since the Apple II originally cost $5,242 in 2017 dollars.

So, given how important Excel has been — and still is — to accounting and finance teams, it stands to reason that there should be a really, really good reason to get rid of it.

Our competition doesn’t “get” accountants

One of our competitors has gone so far as to compare the use of Excel to leeches and bloodletting, two medical procedures that fell out of favor in the 20th century:

<Sigh>

These guys just don’t get it.

Excel is a powerful and flexible tool. Like a katana sword, it must be handled with care. It can do a lot of damage. But it can also be very, very effective in the right hands:

Let’s tackle some of the common arguments against spreadsheets:

Arguments against Excel (and why they’re wrong)

Spreadsheets are full of errors

Errors aren’t unique to Excel — they can worm their way into any system designed by humans. But with Excel, at least you have full transparency and can find the problem.

As Nir Kalssar pointed out above, anyone can dig into an Excel file’s assumptions and formulas to figure out what’s going on.

That’s not always possible for users of specialized databases.

Spreadsheets are difficult to organize

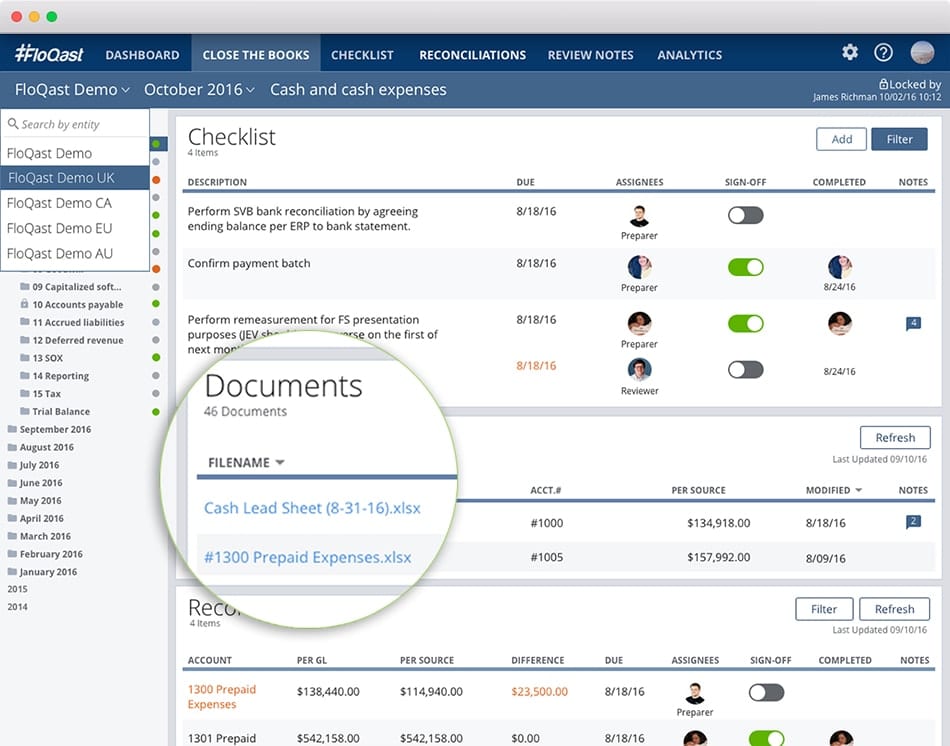

We agree! That’s why we built FloQast.

We organize all of your reconciliation workbooks in the document storage solution of your choosing, such as Box, Dropbox, Google Drive, OneDrive, and Egnyte.

Then we tie back the results of all these workbooks to the trial balance in your ERP system, ensure that everything lines up, and alert you if the two go out of sync during the close.

Now, let’s take a look at some of the disadvantages of enterprise software solutions that try to replace Excel:

Disadvantages of enterprise solutions

Enterprise solutions are expensive

Does that enterprise application display pricing on their website? I didn’t think so. That’s because they don’t want to scare you away. Or maybe they just want to charge you a lot more than the next guy or gal.

At FloQast, we put our pricing on our website because we know that controllers and CFOs don’t have time to waste looking at apps that are out of their budget.

Enterprise solutions aren’t flexible

Enterprise apps might be great for the Fortune 500, but they often don’t best serve the needs of midsize companies, especially those that are growing fast. These companies need agile solutions that scale easily and don’t require a lot of IT support or customization to use.

There are lots of things you can’t do completely in web forms, too. Just try reconciling deferred revenue or performing accrued liability reconciliations in a web form. It’s not going to happen. So you’re back to using Excel, but now instead of relying on derived balances, you have no choice but to resort to cutting and pasting numbers into the web forms themselves.

This is why we built FloQast around Excel, not in spite of it. We layer on top of your existing monthly, quarterly, and annual close process to turbocharge Excel. A big benefit of this approach is that a typical customer is set up ready to go with FloQast by their very next monthly close.

Enterprise solutions lock you in

Ditching Excel might sound nice, but consider the implications. Now all of your data is sitting inside a proprietary system on servers you don’t control in a format that you can’t easily export to other software or systems.

With FloQast, your reconciliation workpapers are still in Excel format stored in cloud document storage that you own (Box, Dropbox, Google Drive, OneDrive, Egnyte, etc.) FloQast sits in the middle, tying together your spreadsheets, checklists, and ERP trial balance.

We don’t try to lock you in, and we hope to see many of our customers in the Fortune 500 someday, even if that means their needs evolve and they decide one day to leave our FloQast family.

Proudly serving midsize companies

There’s something that enterprise software companies have in common — they try really hard, but they just don’t understand the needs of midsize companies. Those needs of a company like Ruckus Wireless are vastly different than those of Coca-Cola.

Controllers and CFOs of midsize companies require agility, flexibility, and interoperability. And if you’re in a fast growing company, multiply that by a factor of ten.

Those accountants, controllers, and CFOs are the customers we serve. After all, we’re accountants who build close management software for accountants. They love their Excel, and we do, too.

If you’re using Excel and are interested in improving your close process, check out our white paper, “Increasing Accounting Efficiency Using Excel in Your Month-End Close.”