Blog - audit

Accounting

The Hidden Benefits of the Annual Audit Process

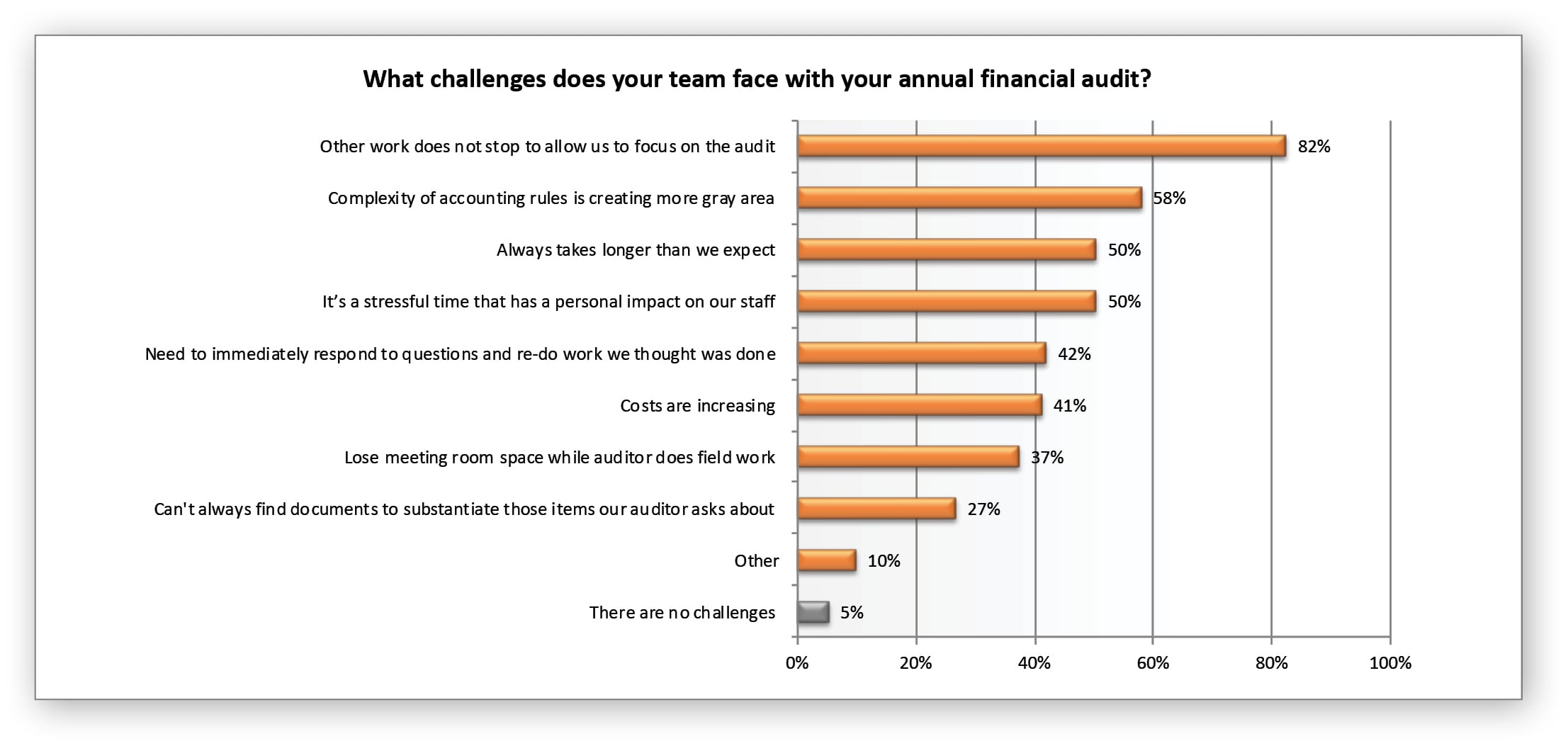

The annual audit process presents businesses with a unique set of challenges that necessitate work weeks and added stress. But with the right mindset and strategic thinking, the process can provide a wealth of insight for future planning — without the expected negativity.

Annual Audits Are Valuable Tools

Despite the disruption and expense, finance professionals understand that they can be extremely valuable tools for the organization, both internally and externally.

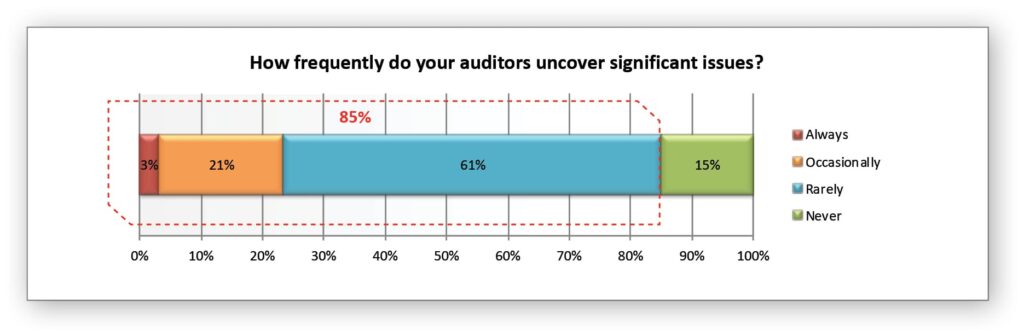

Eight-five percent of respondents report that their external auditors have uncovered significant issues. Moreover, while the majority of audit stakeholders say their auditors uncover significant issues “rarely” or “never,” 24% say that their auditors uncover significant issues “always” or “occasionally.”

Technology Can Help Minimize Disruptions During the Annual Audit

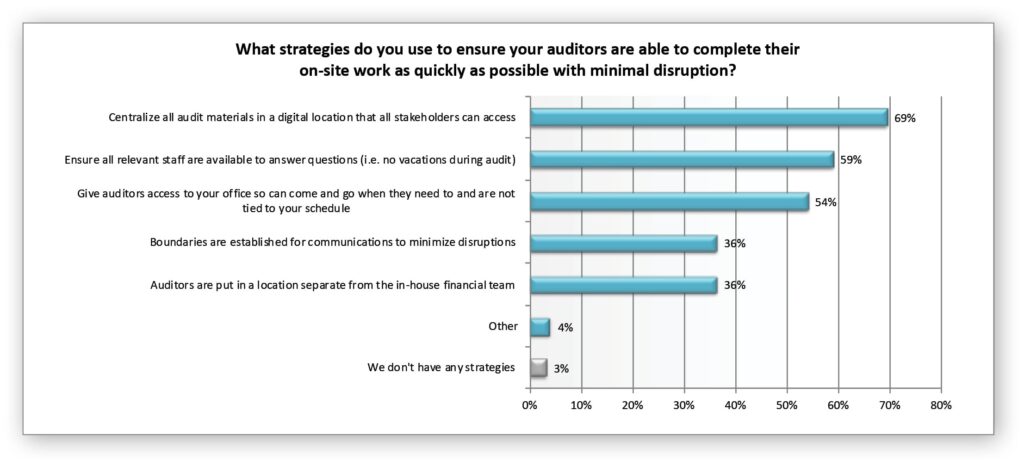

Financial stakeholders are taking steps to reduce the disruption caused by the annual audit process, and many of those steps leverage technology.

Sixty-nine percent of respondents indicate they centralize audit materials in a digital location to allow all stakeholders to access needed materials and minimize interruptions.

Nearly one-third (32%) of respondents in the study have adopted some sort of close management software and have been using it long enough to evaluate the software’s impact on the annual audit. Among those participants, 91% experienced direct benefits from using close management software.

Those benefits include:

- Spending less time on the PBC list – 73%

- Fewer unpleasant surprises – 39%

- Less anxiety about audit results – 32%

- Quicker completion of the annual audit – 32%

Users of close management software are also optimistic about how that software will impact the costs of their audits in the coming years. Forty-three percent of close management software subscribers anticipate substantial growth in their audit costs over the next two years, compared to 53% of participants that don’t use close management software.

Effective Ways of Planning for the Audit

Without close management software, the year-end close process is dependent on labor-intensive activities that rely on disparate checklists, decentralized communications, and tedious reconciliations — all of which hold potential for errors that will slow down the annual audit process.

Eighty-nine percent of audit stakeholders agree that the capabilities provided by close management software would benefit their annual audits. Those capabilities include:

- Ensuring all tasks are fully prepared and reviewed – 66%

- Ensuring all workpapers have been completed and everything ties out – 62%

- Attaching supporting schedules – 61%

- Providing a central repository of supporting documentation – 54%

- Documenting reviews and sign-offs – 53%

- Notifying users when balances or reconciliations have been changed – 48%

- Enabling remote access to supporting documentation – 44%

Close management software can provide several benefits, but they all tie back to reducing the time to close, mitigating errors, and making financial reporting more accurate and efficient — all of which can help make the annual audit less painful.