Blog -

Accounting

Survey Shows that Cloud Accounting Has Passed the Tipping Point

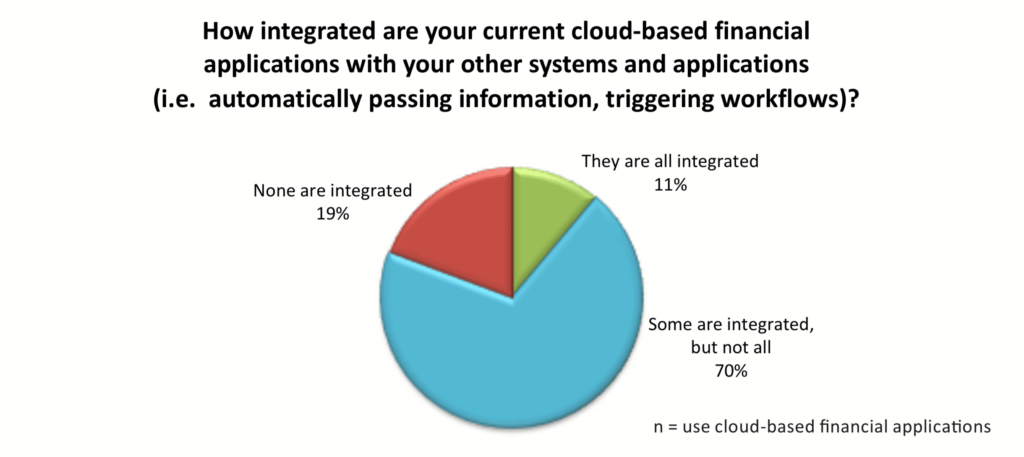

A new survey of accountants reveals that 11 percent of teams have fully implemented integrated cloud accounting systems, and another 70 percent are already on their way.

The “tipping point” probably isn’t what you think it is

In sociology, a tipping point is a point in time when a group rapidly and dramatically changes its behavior by widely adopting a previously rare practice. You may be familiar with the term thanks to Malcolm Gladwell’s popular book, The Tipping Point: How Little Things Can Make a Big Difference, published in 2000.

In his book, Gladwell focuses on fads such as teenage smoking, but the principle of the tipping point applies to just about anything, including the world of accounting. Once a significant minority of the population begins to strongly believe in something, it’s only a matter of time before the majority follows suit, and often very quickly.

An idea is like a virus. So how many people does it take to make an idea go viral? According to a Rensselaer Polytechnic Institute study, just 10 percent. Scientists there found that “when just 10 percent of the population holds an unshakable belief, their belief will always be adopted by the majority of the society.”

What this means is that the tipping point isn’t what you think it is instinctively — at the 50 percent mark. It may not even be at the 25 percent adoption mark. It can be as low as 10 percent. That’s because great (and bad) ideas have the ability to spread from one person to many at an exponential rate.

So what does any of this have to do with accounting?

As a developer of cloud-based close management software for accounting teams, we at FloQast are curious about the impact of cloud accounting on the accounting profession in general.

Is it real, or is it just hype?

We’ve been talking about cloud computing for what seems like decades now. On the surface, it may seem that not much has changed. But dive in and you’ll find that there’s a group of accounting teams that are completely rewriting the rules of how an accounting department works, and what an accountant does on a day-to-day basis.

Here’s what it means to be a “Cloud Accountant”

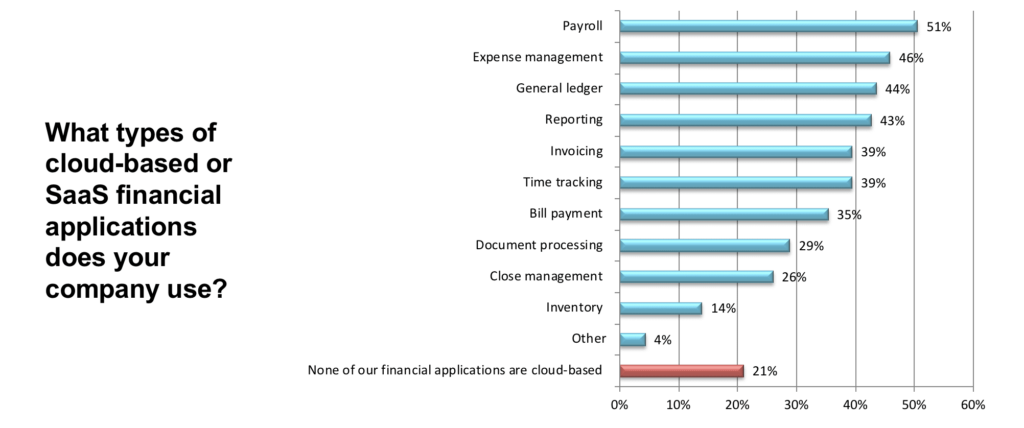

According to a new survey of 506 accounting and finance professionals commissioned by FloQast and conducted by Dimensional Research, 79 percent of accountants are using at least one cloud-based financial application. However, most of them are not yet what we would call true “cloud accountants.” At FloQast, we view getting to cloud as a journey with four milestones along the way:

At FloQast, we view getting to cloud as a journey with four milestones along the way:

- Stage 0: No financial cloud applications

- Stage 1: Financial cloud applications are not integrated

- Stage 2: Financial cloud applications have some integration

- Stage 3: Financial cloud applications are fully integrated

We think it’s only when you get to Stage 3 that you can truly call yourself a “cloud accountant.”

To maximize the benefits of the cloud to your team, all your major financial applications need to be exchanging data through integrations. This significantly reduces time wasted on data entry and the inevitable accompanying human error.

Based on my own experience over the past decade, integrations cut the time to do bookkeeping and basic accounting by 50% or more.

There’s a ton of great insights to be gleaned from the new Cloud Accounting Survey report, but the one that caught my eye the most comes toward the end:

This chart shows that among those accountants and bookkeepers who are using financial cloud applications, 11% are at Stage 3, meaning that they’ve fully integrated all of their financial cloud applications.

Accountants at Stage 3 are far more likely than accountants at Stage 0 to view technology changes as good for their career. In fact, 97% of accountants at Stage 3 view technology positively, and they are five times less likely to view technology in a negative light.

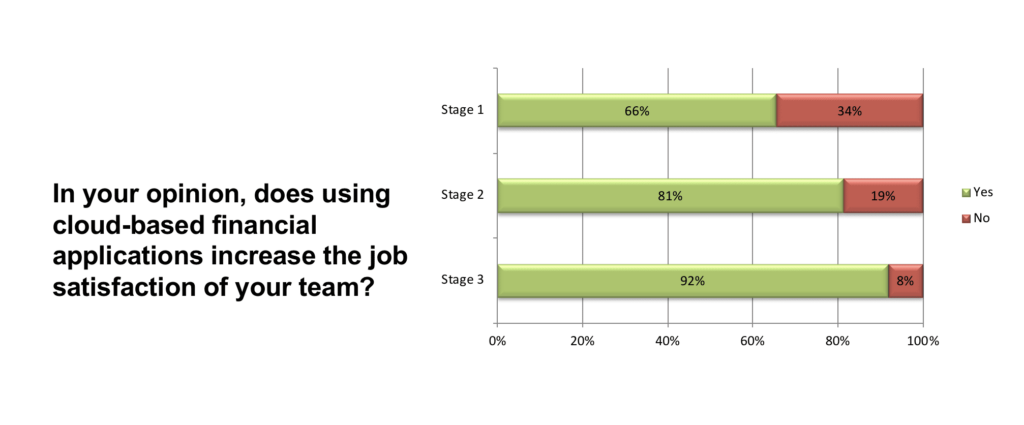

What’s even more dramatic is the ability for cloud accounting to increase job satisfaction for accounting teams. 92 percent of accounting teams that have advanced to Stage 3 of cloud adoption agree that cloud-based financial applications make the team more satisfied at work, compared to 66 percent of accountants at Stage 1, where they are using at least one cloud app but without any integrations.

It’s all downhill from here

It’s clear from the data that integrations are the key to making cloud accounting a positive experience. This is where the battle for cloud accounting is being fought right now.

According to our survey, 11 percent of teams have integrated all of the cloud-based financial applications. That number — 11 percent — is the answer to our question about the tipping point. These are the teams at Stage 3 that have fully moved to cloud accounting. They are seeing major productivity gains and enjoying a better quality of life.

Naturally, they are the “true believers.” Talk to any of them — controllers using FloQast, for instance — and you’ll hear them sing the praises of closing the books in the cloud. They’ll tell you they could never go back to the old way of doing things.

As Gladwell uncovered in The Tipping Point, and scientists confirmed a decade later, once a 10 percent minority develops an unshakable opinion, they inevitably spread their new point of view to the majority of society.

Now it’s just a matter of time.