Blog - accounting, Corporate governance, diamond, diamond foods, Financial reporting, fraud, GAAP, Kelloggs, Pringles, Proctor and Gamble, sec

Accounting

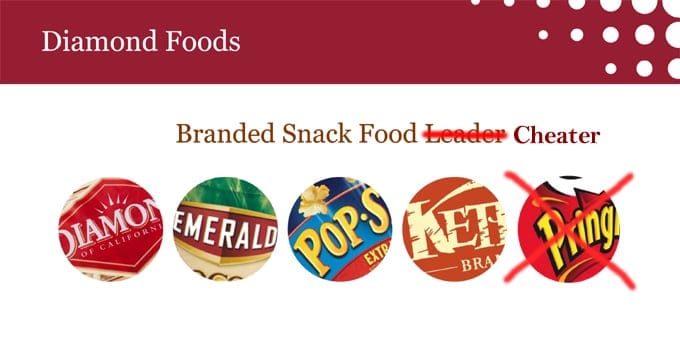

Nutty Accounting Costs Diamond $5 Million

According to a report released on Jan. 9, 2014 by the Securities and Exchange Commission, snack food company Diamond Foods engaged in accounting fraud in 2010 and 2011 that drove up the company’s stock price and allowed the company to engage in acquisition talks for Procter and Gamble’s Pringles line of chips. The company recently agreed to pay a $5 million fine as part of a settlement.

The scheme allegedly began in February 2010 when then-CFO Steven Neil posed an unusual inquiry to his accounting team. He wanted to know the highest amount the company could pay for a pound of walnuts and still beat Wall Street earnings expectations. The team performed an analysis of their costs and reported back that Diamond could afford to pay 72 cents per pound, which was about 10 cents less per pound than the market demanded.

The SEC alleges that Neil then implemented an unusual payment plan to walnut farmers. Under the terms of the plan, Diamond paid farmers a reduced price at the time they purchased walnuts. The company then paid what they called a “continuity fee” in the next calendar year to make up the difference. Walnut farmers who were interviewed in the SEC investigation said they found the plan to be confusing.

The result of the payment plan was that Diamond looked like it had managed to negotiate extremely competitive costs for its goods. The company beat analyst expectations in 2011, driving the company’s stock price to more than $90 per share. That gave the company capital to complete its biggest acquisition ever – the purchase of Pringles from Procter and Gamble.

Diamond’s then-CEO Michael Mendes had a vision for the company to compete with Pepsi for dominance in the snack food market. The Pringles acquisition would have made Diamond the second-largest company in the snack business and would have set up the company for even bigger expansion.

Instead, The Wall Street and other skeptical investors and analysts dug into the company’s accounting records and uncovered the payment plan. The SEC launched an investigation and the company had to restate its financial results from 2010 and 2011, sending the stock price below $13 per share. The Pringles deal fell apart and the chipmaker was ultimately sold to Kellogg Company.

Mr. Mendes agreed to pay a $125,000 fine and neither admitted guilt to nor denied charges that he should have known about the scheme. Mr. Neil vowed to fight the SEC in civil court. His attorney said that he followed the company’s established principles and that his work was reviewed and approved by outside auditors.