Blog -

Accounting

Survey Shows the Line Between Controller and CFO is More Blurred Than Ever

The role of the corporate controller has been evolving for some time, but with the release of “Understanding the Modern Controller: A Survey of Financial Controllers,” we now know just how substantial the transformation is.

Taking a deep dive into insights shared by more than 200 controllers, the survey illustrates how the modern-day controller is taking on responsibilities traditionally associated with the CFO, as well as a more strategic role within the business.

“The modern financial controller does not fit the stereotype of the number-cruncher who hides in his office with his or her spreadsheets and ledgers and sends incomprehensible reports to the CFO who interprets those for the C-suite,” said Diane Hagglund, senior research analyst of Dimensional Research, which conducted the survey. “As the role of the CFO and the overall finance team has expanded, the controller understands how good data about business operations — both financial and non-financial — directly impacts the quality of decision making.”

Blurred Lines

95 percent of respondents — altogether, more than 300 finance and accounting professionals — said that their role is increasingly more important and strategic. 73 percent attributed the shift to the evolving CFO position, requiring controllers to backfill their former obligations personally while delegating many of their own tasks to other accountants.

More with Less

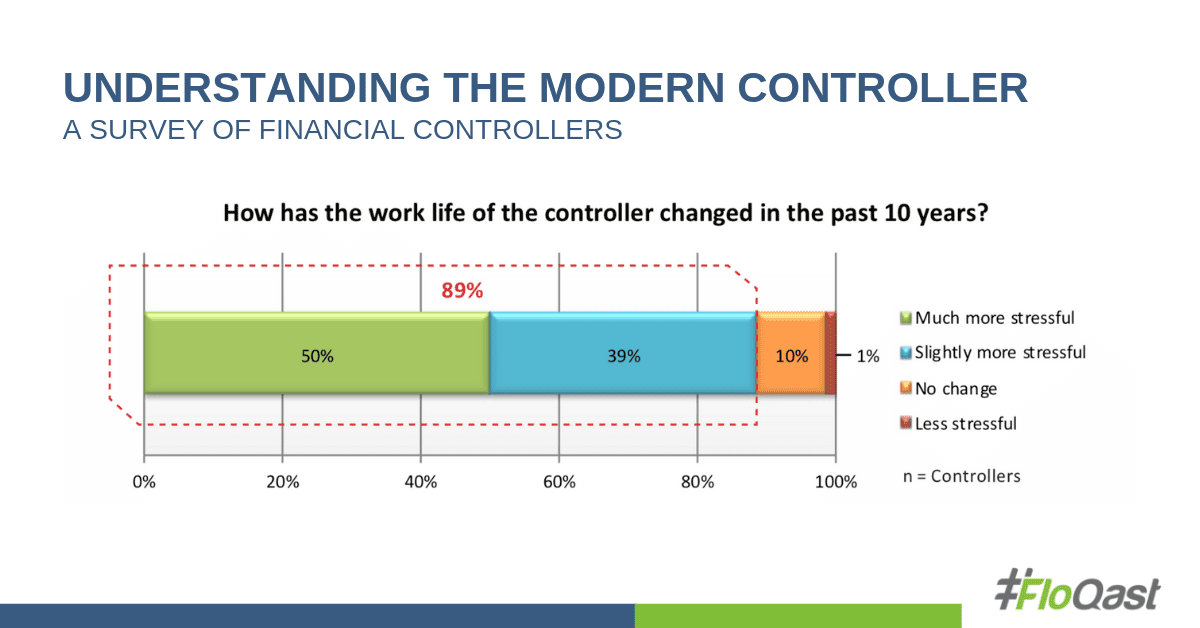

The vast majority (89 percent) of survey participants agree that the controller job has become more stressful. Whether it be the demand for speed (67 percent), a higher volume of work (64 percent), or compliance demands (63 percent), the newly-adopted duties are clearly taking their toll.

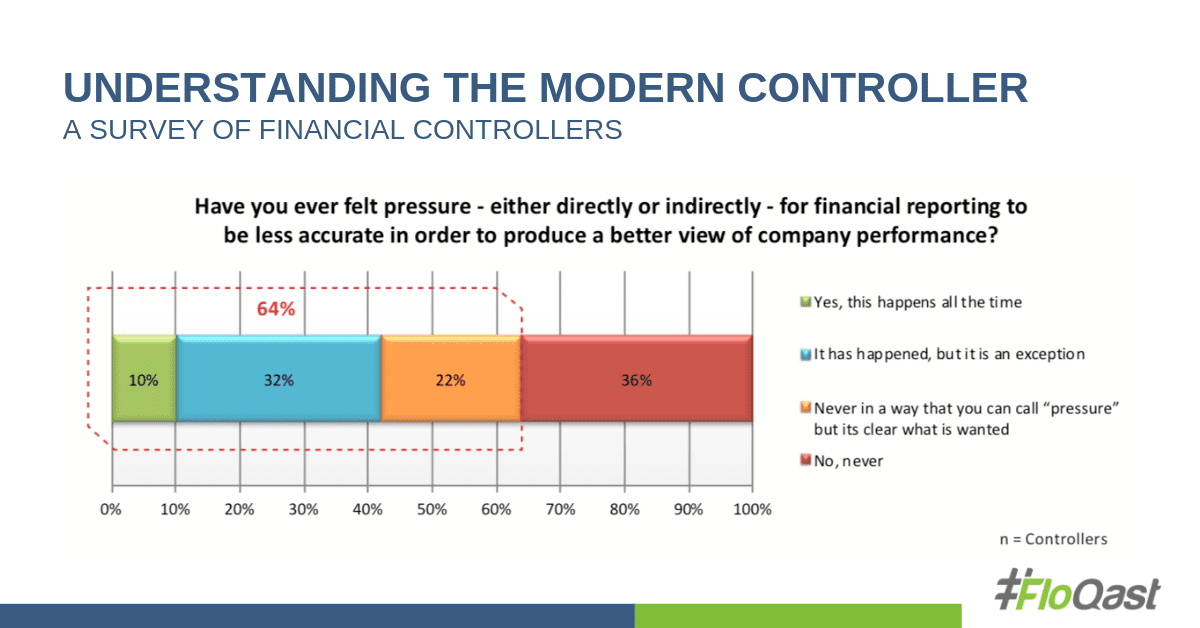

Alarmingly, 64 percent of respondents have been pressured to misrepresent their company’s performance, with 10 percent saying the pressure comes “all the time” and a further 32 percent saying they have felt compelled to cook the books in the past, though it was an exception.

These figures are concerning, to say the least.

The Solution Exists

One thing nearly all survey participants agreed on was how much technology affects their role. 96 percent said that it made a big impact on controllers, but with that impact is a new concern: 78 percent said controllers spend more time than ever on IT management.

With growing pressure to expedite virtually everything, respondents reported that close management software — not ERP or online accounting software — has the greatest potential to positively impact controllers. Oddly enough, 1 percent of professionals who responded to the survey said they believed no software will have a positive impact on the controller, indicating either a supreme level of cynicism or a profoundly remarkable naiveté.

What Does It All Mean?

Between mounting pressure to think more “big picture,” and strain to expedite existing processes, one thing is clear: Being a controller in 2019 is challenging. Implementing solutions to help manage the wide variety of tasks being juggled can substantially limit a controller’s stress, but only if implementation and management are as close to turnkey as possible.

Ultimately, integrating a quality ERP with a potent close management software will help controllers close the books faster, provide better insights to the C-suite, and reduce stress.