Blog - Matching

Company News

From Collaboration to Automation: The Next Step in the FloQast Journey

The genesis of most good ideas can usually be traced back to one very simple thought.

In FloQast’s case, that notion was as uncomplicated as is it gets in the business world: Meetings, on the whole, suck.

FloQast Co-founder and CEO Mike Whitmire wasn’t the first person to come to this realization, and he won’t be the last. After quantifying how much time he and his fellow auditors spent in daily and weekly status meetings, he saw an opportunity for change.

Six years later, FloQast’s mission hasn’t changed. As a company built by accountants for accountants, our team of 150+ employees — including numerous former CPAs and auditors in every department — works diligently to find ways to save accounting teams time by helping them organize, collaborate, integrate, and automate.

Hundreds of businesses have implemented FloQast to improve communication and eliminate bottlenecks, and today, we’re proud to announce a solution that will help accounting teams operate more efficiently than ever before.

Introducing FloQast AutoRec

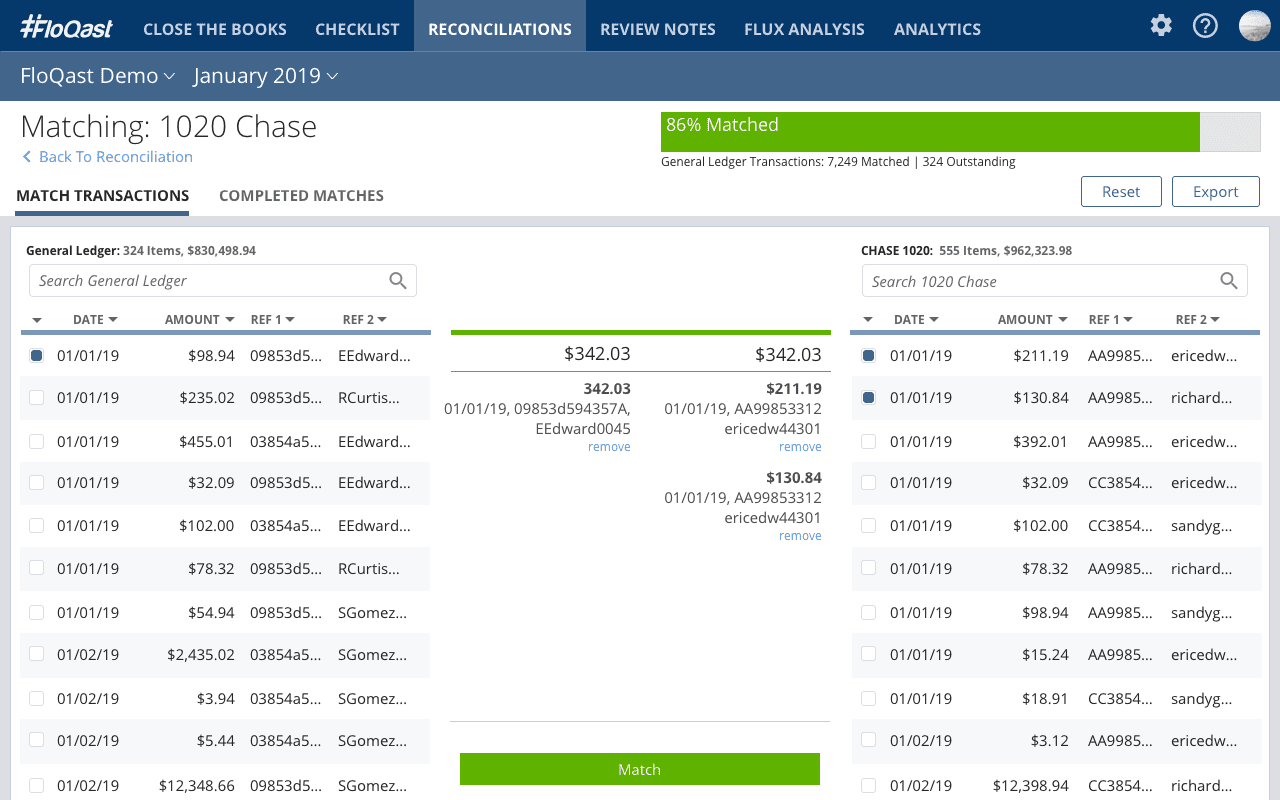

FloQast AutoRec is a solution designed to replace the time-consuming and error-prone methods teams use to reconcile accounts with a large amount of underlying detail.

For instance, many bank and credit card statements contain thousands or even hundreds of thousands of transactions. Accountants typically set aside one or more days each month to reconcile these high-volume accounts using their favorite tool — Microsoft Excel. Aside from the drain on resources during the critical month-end close, manually matching transactions by sorting, ticking, and color coding spreadsheets involves a level of risk that inevitably results in errors and questions from auditors down the road.

At its core, FloQast’s proprietary matching algorithm — powered by artificial intelligence — is capable of handling data sets with hundreds of thousands of records. In just minutes, it identifies even the most complex matches, such as a single payroll journal entry in the general ledger that corresponds to multiple individual checks cut from the bank account (one-to-many matches).

FloQast AutoRec can even automatically create many-to-many matches, such as multiple daily credit card batch deposits recorded in the bank that relate to numerous individual customer payments in the GL.

It’s also capable of matching transactions when reference field descriptions don’t fit exactly, such as “Acme, Inc.” appearing in the GL matching to “Acme.com” on the bank statement.

The Proof in the Pudding

An early adopter of AutoRec, Demme Learning — an educational publishing company headquartered in Pennsylvania — started using AutoRec earlier this year. Having used FloQast to facilitate the month-end close since 2017, the company jumped at the opportunity to automate reconciliations thanks in large part to its convoluted accounting system.

Opting to run AutoRec for the first time in February — traditionally a slow month for the company’s accounting team — Accounting Coordinator Joel Theimer was stunned at the results.

“When I ran matching for the first time, I was surprised to find that the tool matched 97 percent [of transactions] for me right away,” he said. “I’m comfortable that AutoRec won’t miss a digit. It’s not going to transpose numbers and match something that it shouldn’t, where my eyes just running over a file might.”

Moving forward, using AutoRec will allow Theimer to save between 24 and 72 hours each month, allowing him to work on more strategic projects that benefit the organization more tangibly.

“We’re taking that time we spent conducting the close to actually analyze it,” he said. “We’re looking more closely at the numbers and being able to do more reporting to management. We’re not just reporting the results anymore; now we’re looking deeper into what the results actually mean.”

Having dramatically improved the company’s deferred revenue reconciliation process, Joel can expect fewer meetings with auditors, pointing instead to a rock solid reconciliation detailing how each transaction matched individually. Now that’s uncomplicated.