Blog -

Accounting

How to Minimize the Pain of Accounting Team Turnover

I’ve had three jobs in my public accounting career and though they were at very different firms, the one thing I feared more than anything else was that one of my senior accountants would quit and I’d be left to pick up the pieces.

Why was I so afraid of losing one of my staff? Because so much effort had been invested in training each of my team members on the individual details of every client engagement, the unique processes around those engagements, and how to handle all of the various, delicate client relationships.

Transferring that knowledge is a big task, especially when you’re running a Client Accounting Services (CAS) team, also known as outsourced accounting, in which each employee may be responsible for dozens of engagements. In short, turnover is a huge pain.

I’m not alone in this assessment. Accounting Today’s 2018 “Year Ahead” survey found that the top concern among large firms was “recruiting/retaining good employees” (at a whopping 71 percent of respondents). And with a looming global talent shortage, expect retention to become a bigger and bigger problem for small and medium sized teams, too.

We can do our best to make our employees happy at work, but no matter what we do, the competitive labor market will make turnover inevitable. Sometimes the best we can do is damage control. In that spirit, here are three ways to minimize the pain of accounting team turnover.

1. Build Slack Into Your Staffing Model

I blame the time sheet and hourly billing for many of the problems in public accounting today. When you view an employee as a bundle of 2,000 or so hours per year, it’s all too easy to load them up with billable hours to the point that they have no free time to do anything but billable work.

Why is this a bad thing? Because when your staff don’t have slack (no, not the team chat app, which we’ll talk about later) it’s a big problem when one of them leaves.

Nobody with experience will have capacity to take on the extra work. Which means someone who is already carrying a full load has to shoulder the burden, or the work gets offloaded too quickly to someone new who probably doesn’t know what he or she is doing yet. Not ideal.

Another problem with time sheets is that they incentivize your staff to avoid improving and documenting processes, which will be points #2 and #3 on this list. And if you can’t get your staff on board with the plan, it isn’t going to happen.

So, either get rid of your time sheets or at least adopt a model based on billable hours that requires your staff to only be 75 percent billable or about 6 hours per day of client work.

2. Standardize Your Workflow and Processes

A big reason that accounting team turnover is painful is that it takes time to learn the unique intricacies of all the processes in a particular job or client engagement. But what if there wasn’t so much to learn? What if your processes were mostly the same? It sure would be a lot easier to move staff around to different jobs on the team and swap in someone else when someone leaves or is on vacation.

On an outsourced accounting team, like the ones I’ve managed, the key to standardizing process is to use the same “tech stack” and associated workflows for every client. By tech stack, I mean the set of cloud applications we use to pay bills, run payroll, prepare financial statements and all the other aspects of running a CAS practice.

In my own outsourced accounting firm, we used one app to process all accounts payable for our clients. Every client was set up with the same AP approval workflow and processing schedule. The same was true for payroll — we only supported one processor. If the client wanted to use something else, that was fine but they’d be responsible for it.

Standardizing processes makes it easier to swap out staff for other team members. There’s not a lot that’s new to learn when switching clients or areas of responsibility.

The same is true for staff working in-house. There’s a lot that can be done to standardize processes in accounting departments.

For example, make sure that your staff are using the same templates for their reconciliations. You get a consistent, streamlined preparer process and everything is much easier to review when it follows the same format. If you’re looking for some examples, check out these free Best Practice Excel Reconciliation Templates.

3. Document Everything and Keep it Organized

It’s amazing how much knowledge on accounting teams isn’t documented anywhere. Instead, it’s archived in the minds of our brilliant staff. And when they leave, they carry all that knowledge straight out the door. That’s why it’s essential to get your team to document everything they do in a shared close checklist that’s rolled forward and updated every month.

When it comes to review notes, it’s essential to get those out of email, where knowledge is siloed with just the individuals on the email thread chain. Instead, collaborate on review notes in a shared workspace where the whole team (and any newbies) can access the thread when needed.

There are a number of excellent collaboration tools such as Slack and Microsoft Teams that are available for free to teams of all sizes that make excellent email replacements. I advise to get your documents out of that local network drive and into cloud storage.

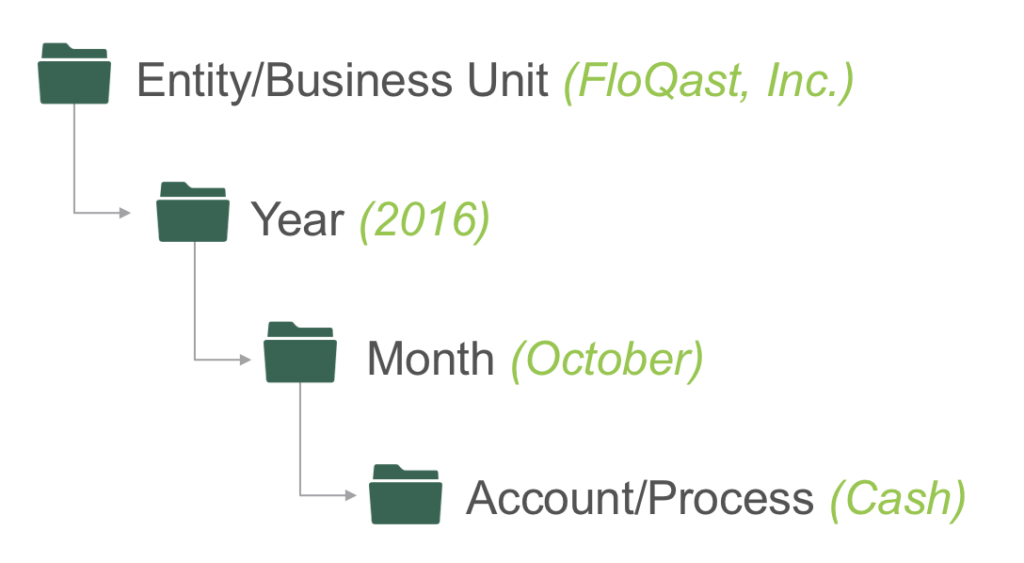

Top cloud storage services such as Box, Dropbox, OneDrive and Google Drive are all affordable and secure. Rather than organizing documents into folders by staff person, set up a hierarchy of Entity > Year > Month > Account/Process. This way someone unfamiliar with the personnel (such as an auditor) can find what they need quickly.

Bringing it All Together

If your team is heavily involved in the monthly close, you also may want to consider close management software, which ties together all your checklists, review notes, and documents in one application.

Whatever technology you choose, make sure it’s consistent from client to client. Give your team the time to tighten up and document processes and you’ll be much better prepared the next time a key team member departs your firm.

This article was first published at AccountingWEB.com.