Blog -

Accounting

The War on Excel

If there’s one universal truth among accountants, it’s this: They can’t live without Excel-based accounting. Not even if they wanted to (which they don’t.)

For starters, it’s ubiquitous. Microsoft introduced Excel in 1985, started outselling Lotus 1-2-3 in 1988 and has been part of accountants’ lives ever since. For a lot of people, it’s difficult to imagine life without it. They turn to Excel accounting functions for grocery lists, personal budgets and even artwork!

Excel, in short, is an amazing invention. It has improved accountants’ lives immeasurably. Let’s talk about why:

Why financial pros love Excel-based accounting

Part of the beauty of Excel is its simplicity. It delivers a seemingly infinite number of rows and columns for inputting data of all kinds. Then it organizes, massages and manipulates that data into charts and tables for presentation. In all kinds of accounting departments, Excel is the common language between their world and the world of their outside auditors, consultants and tax advisors.

Since every business needs accountants, Excel’s flexibility and functionality make it a perfect tool. Teams use it to build reconciliations, financial models and it’s the perfect place to dump a huge amount of data from an ERP or other system. From there, users apply Excel’s accounting functions and features to turn a massive wall of figures into meaningful information that helps people make business decisions.

And since the data pile grows larger every day, the skills needed to sort through it become more important. Accountants who can succinctly interpret these datasets will be valuable employees within their companies.

The Excel accounting backlash

Somewhere along the way, however, Excel made some enemies. You don’t dominate for three decades the way Excel has and not pick up a few critics. Perhaps not surprisingly, Excel’s greatest strengths are also its greatest weaknesses. Its flexibility allows for increasingly complex spreadsheets that baffle its users and can be prone to errors. Human errors, that is.

Yep, sorry to say that the weakest link in this chain is us. Many Excel users rely on manual inputs, making human error inevitable. One study that Excel haters like to cite found that almost 90% of spreadsheets contain errors. That’s pretty frightening, but when you consider that a spreadsheet built by two renowned Harvard economists contained a significant error, then the rest of us can feel a little better. But more importantly, in the abstract of the study, the author admits that the “error rates […] are in line with those in programming and other human cognitive domains.” In other words, totally normal!

Lots of people build their spreadsheets from scratch, manually inputting data and the formulas. The old adage “garbage in, garbage out” is perfect for discussing the integrity of many Excel spreadsheets. Plus, manual entry is very time consuming. In case you haven’t noticed, keying in data has gone out with powdered wigs and the the horse and buggy.

The solution to reducing errors in spreadsheets is, again, found in the abstract of the study: “Surveys of spreadsheet developers indicate that spreadsheet creation, in contrast, is informal, and few organizations have comprehensive policies for spreadsheet development.”

When your team builds spreadsheets with specific rules and guidelines, fewer errors will occur. Again, it’s up to the humans to exhibit some discipline so that Excel-based accounting can do what it does best.

Another problem is people’s annoying tendency to use Excel for tasks for which it wasn’t designed for. A CRM tool is one example. Financial reporting is another. Square peg, round hole, you get the idea. There are other haters who say that Excel isn’t collaborative enough or is just plain ugly. Those might be valid points as well, but the bottom line is, when it comes to Excel’s shortcomings, we have met the enemy, and he is us.

But that doesn’t dissuade accountants from using it. And the best remedy for error-prone spreadsheets is to build a team that does exceptional work. Excel accounting strengths far outweigh its weaknesses and a disciplined team of accountants will know how to best minimize their mistakes.

Excel imitators

A lot of people — ahem software engineers — seem to think that accountants don’t know what’s best for them or how to best do their jobs. Why else would we see all these new apps on the market claiming that they can replace Excel?

Microsoft has been improving Excel for 30 years. It isn’t perfect, but no application is. It’s been interesting to watch developers try to build replacements for Excel and only come up with solutions that amount to “Excel Lite.” In fact, it’s pretty arrogant for any company to think that they can reinvent the wheel. Google, perhaps the most innovative company in the world for the past decade, hasn’t come close to matching the power and functionality of Excel with its Spreadsheet application. Google! If they’re falling short, how can anyone else expect to improve the spreadsheet?

Innovation for the sake of innovation is a quintessential symptom of Silicon Valley entrepreneurship and that’s what a lot of these “Excel killers” feel like — low-grade innovation. And it’s silly for technologists to try to build something for which accountants aren’t asking.

Accountants don’t want a replacement for Excel

Accountants don’t want a replacement for Excel

Here’s the thing that most technologists who build Excel-killer apps don’t seem to understand — accountants like Excel! They don’t want anything to replace it! That’s why FloQast complements Excel, helping accountants make their close process less painful.

But if you don’t believe us, you can read the reviews that G2 Crowd users are leaving us. They focus on how FloQast works with Excel accounting rather than replacing it. But we’ll let the users do the talking:

“The ability to automatically reconcile our ERP (SAP Business ByDesign) against our soft-copy Excel reconciliations via FloQast provided us the capacity to focus more on a qualitative review of our financial statements and reduce reconciliation differences previously detected via a manual tick and tie process.” — G2 Crowd user James Walker, Ruckus Wireless

“Before FloQast we had many pain points. We had reconciliation lead sheets that had to be rolled forward each month, but would become out of balance as soon as a post-close journal entry was booked, but no one would know. We had a close checklist and standard journal entry checklist in excel that needed to be updated daily by many members of the team simultaneously. We were growing our business and adding legal entities every month, blowing up the close checklist. And our Accounting Manager would have to count out the business days from a calendar to determine close due dates! Now all of this is automated on a cloud platform where we can all collaborate on the close process and get notifications if reconciliations go out of balance.” — G2 Crowd user Lauren Clifford, TeleSign

How FloQast compliments Excel

In case you haven’t picked up on it, we here at FloQast love Excel. We’re biased, of course, since two of our founders are accountants. But that also gives the advantage of knowing a thing or two about how they think.

We know the pain points for accountants in the close process because we experienced them. This allowed us to design and build a platform that closes the gaps between your beloved Excel accounting spreadsheets and your ERP.

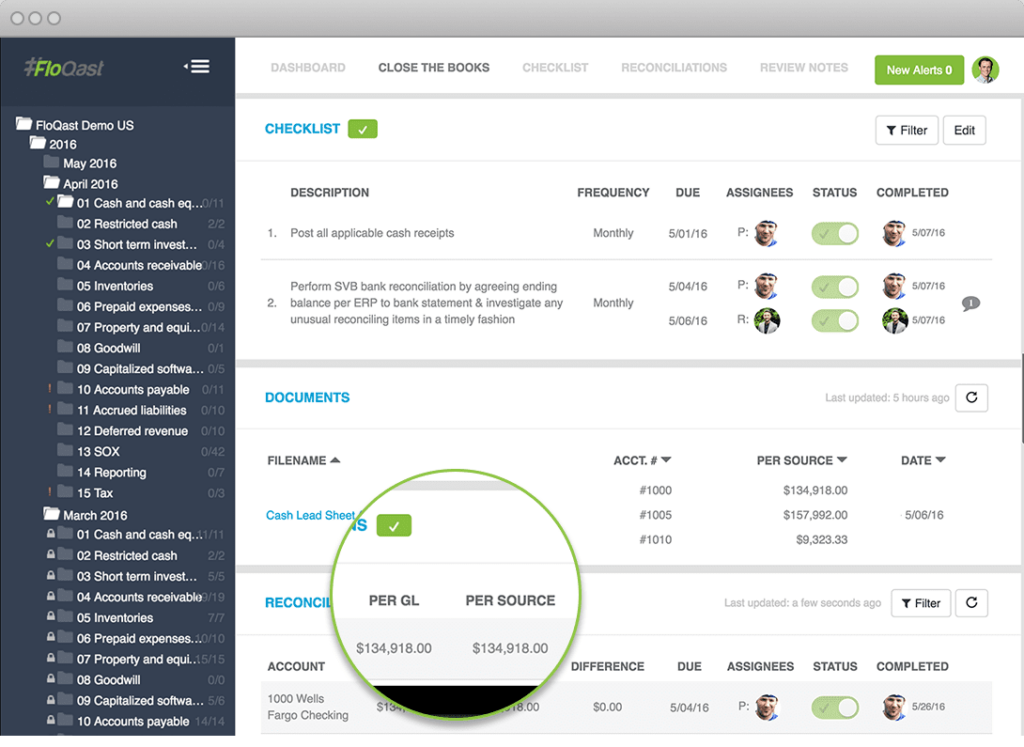

And when FloQast pulls in your Excel file, everything is there as it should be:

And you can compare balances from that spreadsheet to the figures in the ERP:

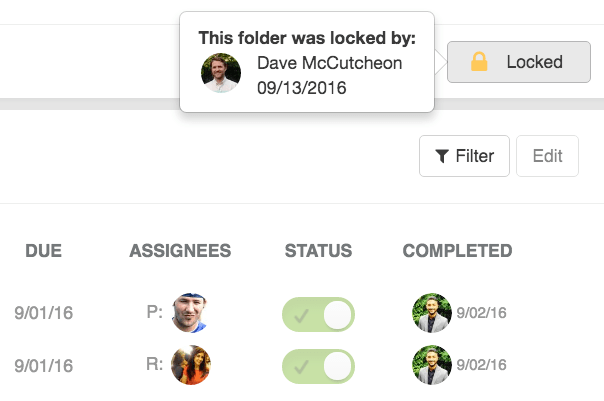

Once everything ties together, FloQast allows you to lock the balance, just like your ERP. If a user changes the Excel balance (as has been known to happen), FloQast saves a secondary file with the modified balance and identifies the user who made the change. This provides an extra level of security after closing an account.

Excel’s other big weakness is that it lacks a collaborative platform. Even if two users can now work in Excel, it’s cumbersome and requires a lot of ongoing maintenance. FloQast makes it easy for teams to collaborate, for managers to assess their team’s performance and adjust strategy, if necessary.

Excel is a powerful tool for all kinds of accounting departments. Building something to replace it is a fool’s errand. Nothing can match its flexibility and functionality. Accountants want something that can pick up the slack where Excel falls short, especially during the monthly close process.

And that’s where FloQast comes in. We want to stop the war on Excel-based accounting and to bring peace to accounting departments everywhere with a simpler, more collaborative close process. We want to be accountants’ new best friend, with the understanding that we know we aren’t replacing accountants’ real best friend. We will never come between accountants and Excel.

[button color=”accent-color” hover_text_color_override=”#fff” image=”default-arrow” size=”medium” url=”https://floqast.com/product” text=”Why FloQast?” color_override=””]

[/vc_column_text][/vc_column][vc_column column_padding=”no-extra-padding” column_padding_position=”all” background_color_opacity=”1″ background_hover_color_opacity=”1″ width=”1/6″ tablet_text_alignment=”default” phone_text_alignment=”default”][/vc_column][/vc_row]