Blog - ASC 842, Lease Accounting

Accounting

How ASC 842 Lease Accounting Helps Controllers Become Strategic Partners

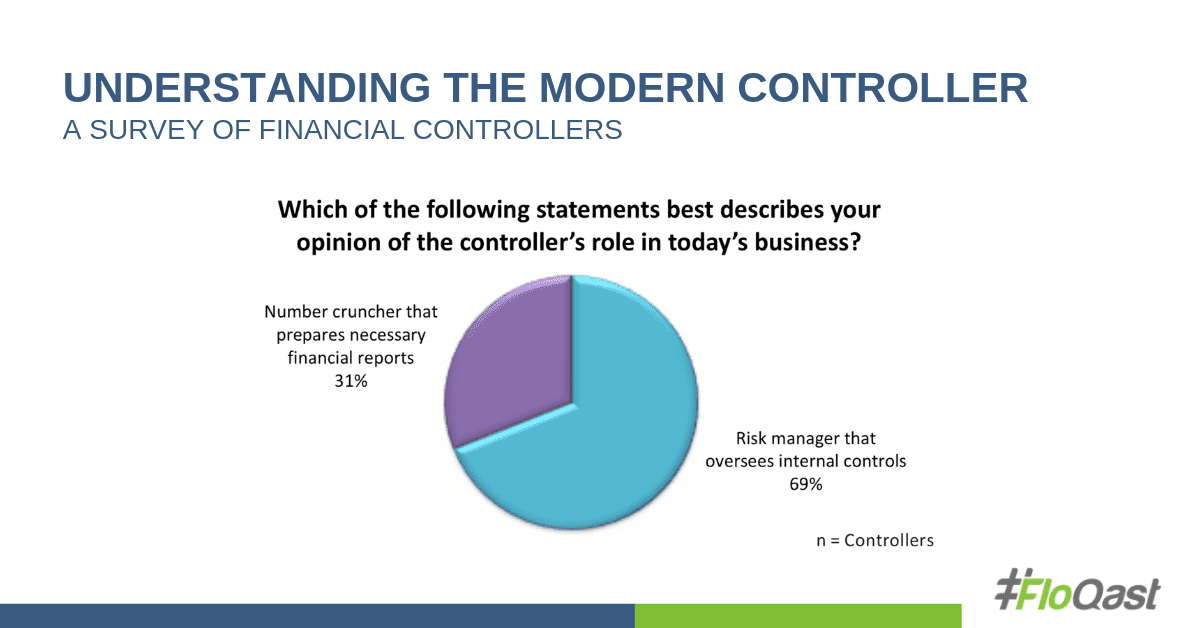

Over the last decade, the role of the controller has shifted from a strictly debits and credits, compliance and reporting job, to a significantly more strategic role, as our recent survey shows.

According to the accounting and finance professionals surveyed, 95 percent say the role of the controller is becoming more strategic, and 69 percent see themselves as risk managers rather than report compilers.

However, according to a recent report from Deloitte, most controllers still spend 70 percent of their time on traditional tasks, such as closing the books and compliance with accounting standards.

With FASB’s update to lease accounting standards, ASC 842, controllers have the perfect opportunity to become more of a strategic partner by working more closely with the rest of the organization build better processes.

How ASC 842 Redefines Leases

Starting in 2019, public companies have to put all leases lasting 12 months or more on the balance sheet. Non-public companies get another year. Central to FASB’s new standard is a new definition of a lease. A lease is now defined as, to paraphrase FASB, an agreement that gives one entity the right to use a tangible asset that belongs to another entity for a period of time. This means that operating leases will go on the balance sheet for the first time, though accounting for capital leases will stay pretty much the same as it’s been for decades.

With this new broad definition, companies are discovering more leases than they initially thought. Leases can be embedded in service contracts or supply arrangements that don’t even mention the word “lease.” If a contract mentions a specific asset to be used to fulfill that contract, chances are, it’s a lease.

Here’s an example from PWC’s excellent guide to ASC 842:

An auto manufacturer contracts with a parts manufacturer to make hood ornaments. The parts manufacturer designs and builds a die in the form of the auto manufacturer’s logo. Outwardly, this looks like a supply contract. But the custom die — a specific asset — has to be used in order to fulfill this agreement. So this agreement has an embedded lease in it.

First, Look Under Every Rock for Hidden Leases

The first step in implementing ASC 842 is identifying all of your company’s existing leases and gathering the documents. Depending on the size and reach of your organization, this might be a formidable task. Besides the agreements helpfully labeled as leases, you might have to search asset registers, purchase orders, A/P, and even the P&L for payments that look like they could be lease payments. If you have international operations, you may need translations. If you have long-standing leases for real estate, those paper documents may be in poor condition.

Now, the accounting team will need help from the whole organization to unearth all the contracts that might now be classified as leases. At the very least, you’ll need help from procurement, IT, operations, and legal.

Then, once you find all the agreements that might be leases, you’ll need ongoing education to make sure everyone can identify leases on a go-forward basis and send them to accounting to get them in the system.

I’m Not an Accountant. Why Should I Care About Accounting Standards?

Yeah, the rest of your organization may be weirded out that accounting is talking about FASB and accounting standards with them, and you’re likely to get pushback because no one has any extra time for your project. The thing is: Everyone needs to be taught that the ways deals are structured can have a lasting impact on the balance sheet.

Here’s another example from PWC’s guide to ASC 842:

Manufacturing Corp makes an agreement with Warehousing Corp to store excess inventory for the next three years. If the contract specifies the storage conditions so that only one location in Warehousing Corp’s warehouses will satisfy the contract, this is a lease. If Warehousing Corp is free to substitute different locations and to change those locations at will, this might not be a lease.

Even though contracts for these small items might look immaterial, in the aggregate, your auditors might not agree. The hazard of establishing materiality thresholds is that other parts of your organization might become complacent and might not send you all the agreements that you need to look at.

ASC 842 Isn’t Just a One-Time Sprint. This Is a Marathon.

Remember that collecting all your old leases and figuring out the accounting for them is just the beginning. Collecting lease documents, analyzing them, and figuring out the accounting will become part of your normal workflow from now on.

And it’s not just identifying leases from the outset — changes to agreements that previously weren’t a big deal can now trigger remeasurement, which is why a major chunk of ASC 842 is dedicated to that.

Under the old standard, remeasurement happened only when the lease itself was modified. But under ASC 842, changes to circumstances or to estimates that impact the amounts of future lease payments can require recalculating the present value of the remaining lease payments. This means that you’ll need to make sure that anyone who has the ability to authorize these changes knows that they need to keep accounting in the loop.

Excel Might Not Be up to the Task Anymore

Unless your organization has only a handful of leases, spreadsheets in a shared drive won’t be adequate to keep track anymore. Consider close management software as a solution to organize all your contracts, amortization schedules, and reconciliations in a single place to manage the month-end close.

If you’ve got lots and lots of leases, then you might also want to also consider lease management software to assist with the unique complexity of lease calculations and the added requirements for disclosures. Remember: This is a lifelong change for your company, so you’ll need a sustainable solution.

Best-of-breed solutions are cloud-based, and besides automating the calculations for your financials and journal entries, they include integrated document storage and allow auditor access. Using lease accounting software in combination with close management software will save you a huge amount of time over using Excel alone. Plus, by putting all your leases in a centralized location means anyone across your organization can find the information they need when they need it.

Taking on a more strategic role in your company means deepening your understanding of how the different parts operate and giving everyone the data they need to make decisions. It’s the perfect excuse for improving your visibility as a leader within the organization.