Blog -

Closing in ERPs

What is Close Management Software

Would you like to shave time off your month-end close while simultaneously improving the accuracy of your numbers? By using close management software, you can put an end to the mind-numbingly boring manual tasks and streamline your inefficient reconciliation processes.

In brief, close management software helps accounting departments by reducing close time, reducing errors, and streamlining financial reporting. Here’s how it works:

REDUCE DEPENDENCE ON LABOR-INTENSIVE MANUAL TASKS

While ERPs and modern accounting systems are great for tracking transactions, they’re not so great for reconciling account balances. That means accounting staff rely on their beloved Excel to do all those account reconciliations. But tying out the data from your general ledger to the spreadsheet requires an error-prone manual effort. Plus, Excel can’t be locked down, and with no audit trail, there’s no way to track when changes were made and by whom. Even rolling forward your reconciliations can accidentally introduce errors if this is done manually.

Close management software acts as the missing link between your ERP and your reconciliations. By automating the process, reconciliation is a snap when data from the GL, Excel and other systems can be easily compared. Some systems allow accountants to retain their familiar workbooks, while others have a proprietary reconciliation module.

Because of the dynamic link between the ERP and the reconciliations, when a journal entry throws a reconciliation off, the software flags this so it can be examined right away. Real-time notifications of discrepancies mean you can address the problem now when memories are fresh, not at the next period end. Multiple versions of workbooks are eliminated, and you know your books are always in balance.

Automatic roll-forward of your checklists, reconciliations, and other schedules saves you time on getting started every month. This also keeps your auditors happy because this ensures consistency and accuracy of assumptions.

STANDARD PROCESSES IN. TRIBAL KNOWLEDGE GETS SHARED

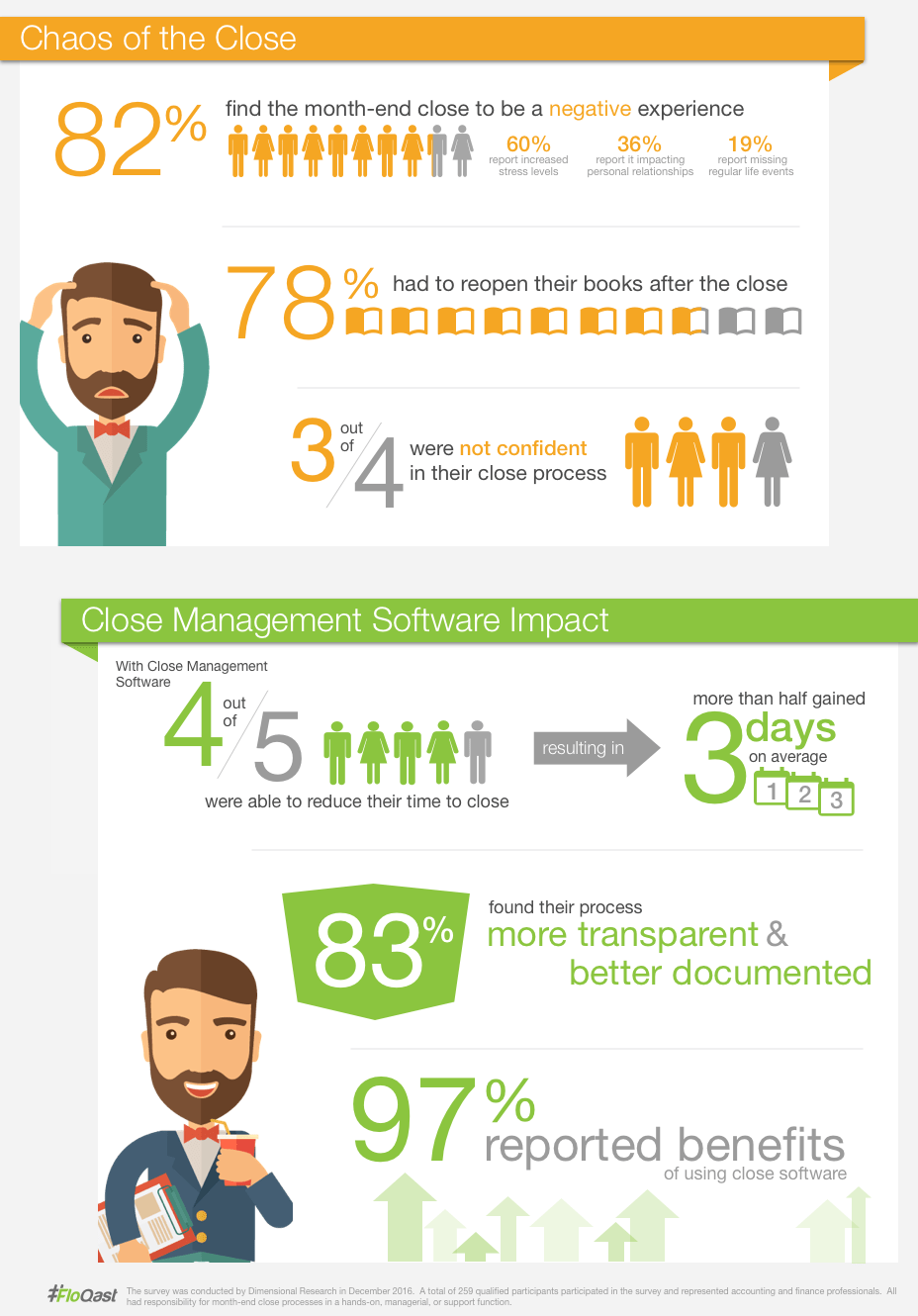

Excel checklists are great for keeping track of lists of tasks, but aren’t so good at sharing how that task gets done. Without documentation of how processes are performed, tribal knowledge becomes rampant, a problem noted by seven out of ten respondents in OUR SURVEY ON THE CLOSE PROCESS.

With close management software, your financial close processes can be easily documented, standardized and continuously improved. Onboarding a new team member becomes a piece of cake. And there’s no need to panic when a team member leaves or has a family emergency and can’t be there for the close. Someone else can pick up the pieces and keep going.

The best close management software systems allow you to keep working the way you’ve been working, and allow for the incorporation of your existing checklists and procedures. And if you don’t have processes, the system will help you create ones that work best for your team.

COLLABORATION MADE EASIER

Traditionally, the controller controls the process, and might be the only one with access to the central checklist — and the only one with a big picture view of the whole close.

Close management software makes the process transparent to everyone involved by displaying all the tasks and their status in a central dashboard. Everyone can easily see which controls have been performed and what they need to do next. Bottlenecks are readily identified. Easily assign and track tasks so you keep everyone accountable and on schedule. Micromanagement is gone. There’s no need to waste time in status update meetings. And better yet, no more endless email chains because review notes are all right there.

Job satisfaction gets a boost when everyone on the team has a greater sense of ownership for their tasks. Creative thinking to find better solutions becomes the norm.

Improving collaboration is key to retaining and engaging the millennials at your firm. When you improve transparency by showing everyone where their tasks fit into the big picture, it’s easier for everyone to understand and to see ways to improve the process. Some close management software also has simple built-in channels for senior staff to share advice with the newer staff members.

ALL YOUR DOCUMENTS IN ONE PLACE, EASY TO FIND

No more searching bulky binders, file cabinets and email chains to find that elusive document you need to tie out a balance, or that you need for the auditor’s PBC list. Close management software saves you time by saving documents with their associated accounting process. The review process is faster — not only does the dashboard show you what’s ready for review, but the documents you need are just a click away.

Your auditors will love you when 100% of their PBC list is in one place. No need for lengthy discussions to explain your processes when you can just point them to your financial close management software, and they can take it from there. Plus, with clear visibility into privileges assigned to accounting team members, they can increase their reliance on software for internal controls. All of this means fewer hours billed by the audit team — which gives you the advantage when negotiating audit fees.

CLOSE FASTER AND BOOST ACCURACY AT THE SAME TIME

The traditional mantra for closing is that you can get it fast or get it right, but not both. Close management software helps your team get it done faster without sacrificing accuracy by automating reconciliations, streamlining your processes, and providing an easy platform to improve those procedures. When complex tasks are broken into simple repeatable steps, it’s easier to get through them systematically and efficiently.

FASTER CLOSING MEANS MORE TIME TO DO WHAT REALLY MATTERS IN YOUR BUSINESS

When you get accurate numbers sooner, there’s more time for strategic planning and higher level analysis. More time to look at results, and improving those results for the next month — while it’s still the next month. Transform your team of data processors into interpreters of information.

CFOs love having numbers they can trust when they talk to the board or the auditor. The easy visibility into the status means less time worrying about the close and more time to work with the CEO on strategy for today’s fast-moving economy.

CHOOSE THE TOP-RATED SOLUTION

Now that you know how close management software can help you save time, improve accuracy, and make the month-end close easier, why not take a spin on FloQast, the top-rated solution. FloQast was created by accountants, for accountants. It’s an intuitive solution that brings collaboration, reporting and process management together to centralize management of the close.

FloQast is in the cloud, so you can be remote ready in a snap. Your team can collaborate in real-time, whether they work in the office or are spread across the United States or around the world.

FloQast works with your existing checklists and Excel workbooks to work the way you work. You can be up and running in less than two weeks. On average, FloQast customers close three days faster. Just imagine — What could you do with three extra days every month?